Audio vs. Video Podcasting: The Cost of Attention

Video podcasting via algorithmically-driven platforms like YouTube and Spotify promises creators more and better discovery opportunities than have ever existed in podcasting. But how much does it cost to capture the potential upside? And is the outcome worth it?

Presented By

What’s the ROI on Video Podcasts?

Video promises podcasters new opportunities for discovery, growth, and connection.

But do video shows actually perform better?

And even if so, is the additional cost associated with video worth the benefits?

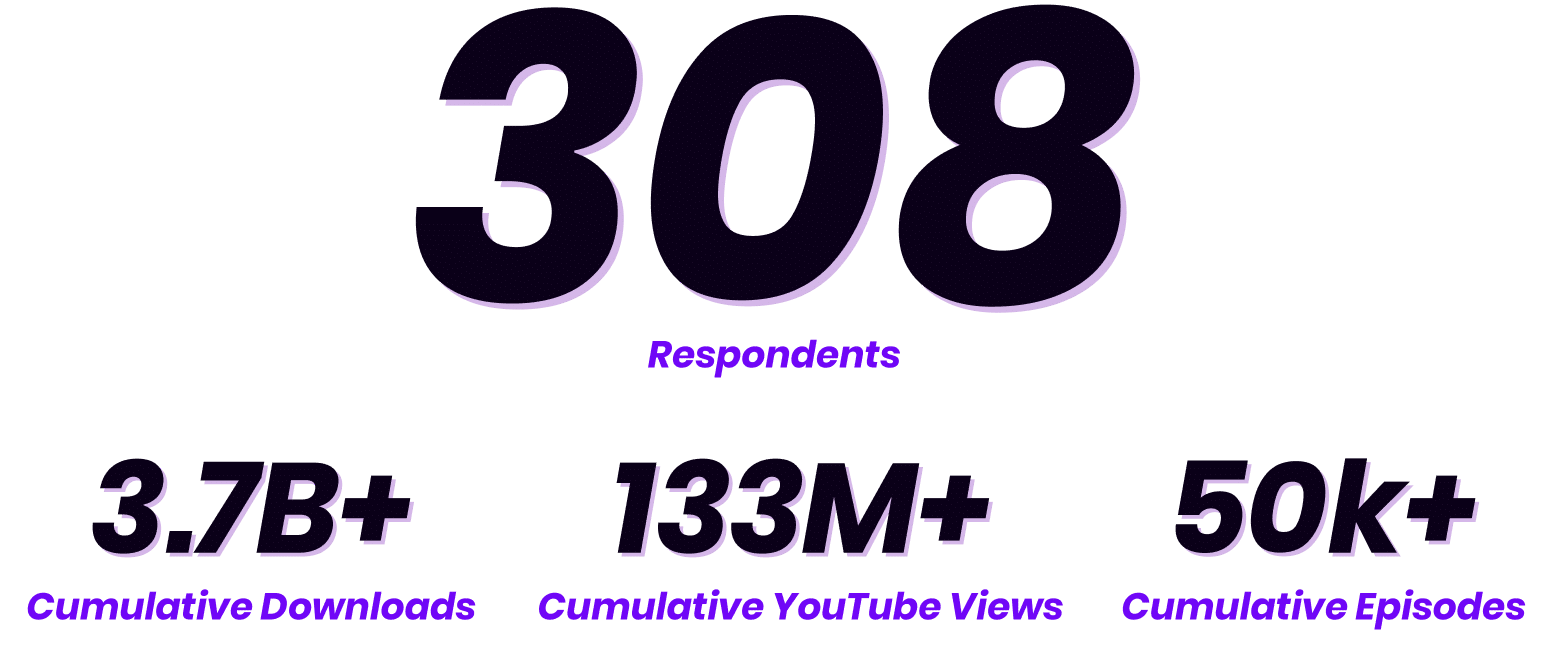

To get to the bottom of these questions, we enlisted the help of 308 podcasters and industry professionals from a diverse set of personal backgrounds, niches, formats, and experiences.

This report explores what their responses told us.

What the Data Says About Which Podcast Format is Best For You

01

About the Respondents

Our respondents offer a nuanced perspective on podcast creation and growth.

Together, they represent a diversity of continents, countries, languages, show formats, topic categories, reasons for creating, and more.

Here’s a little bit about who they are.

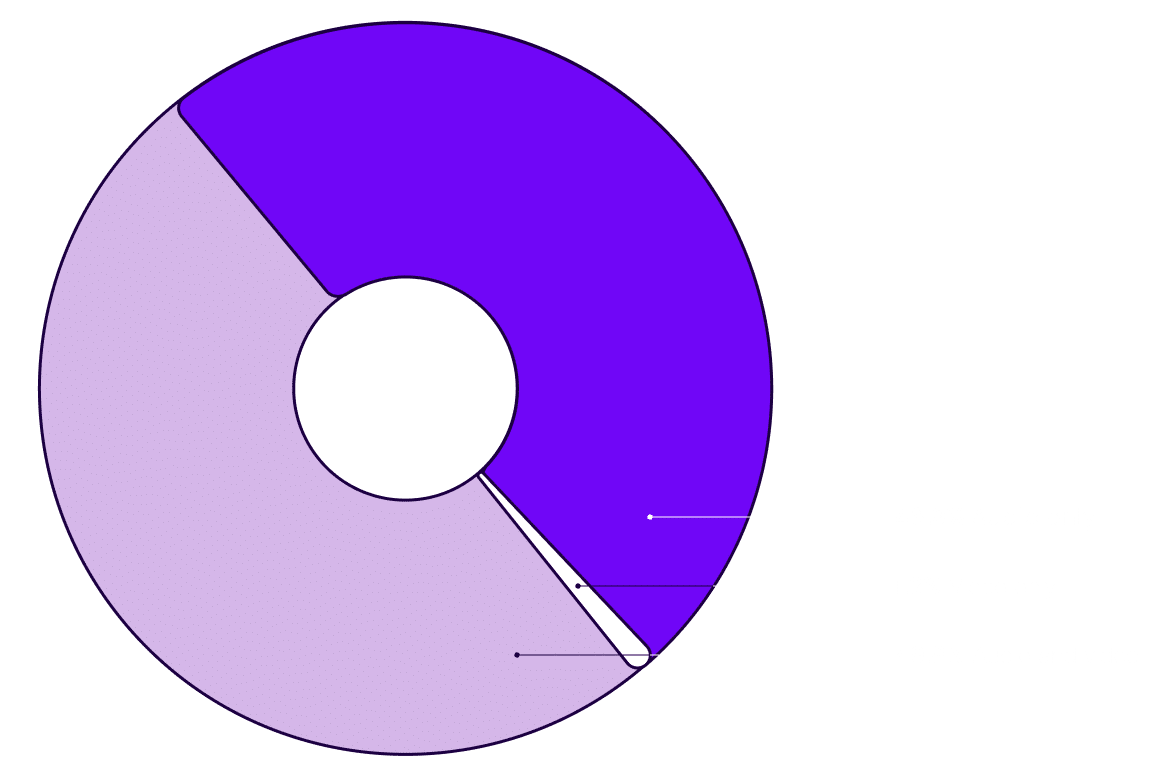

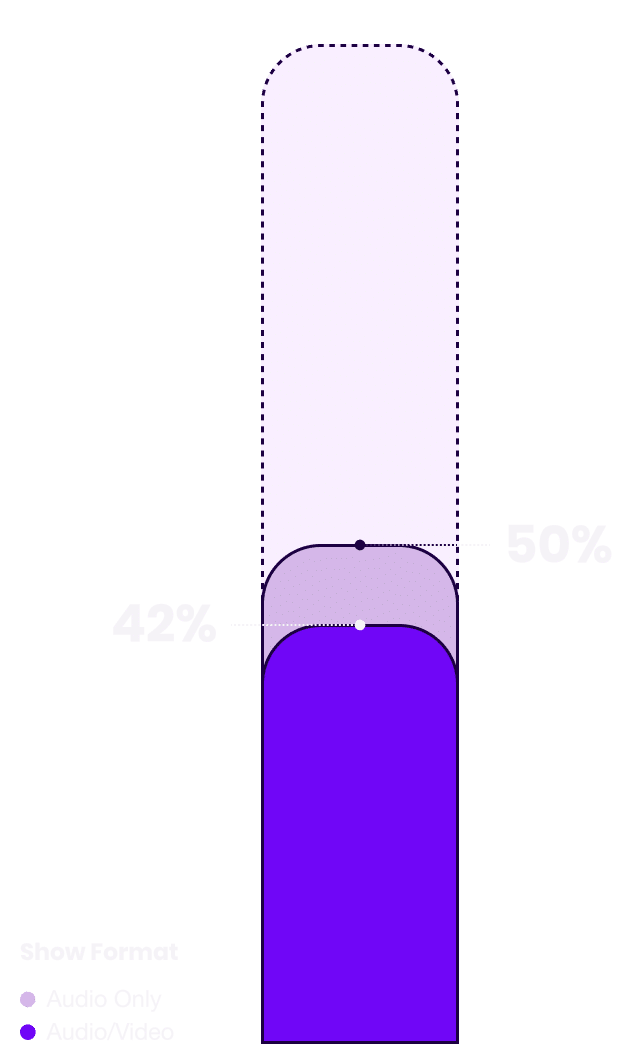

Audio, Video, or Both?

Role In the Podcast Industry

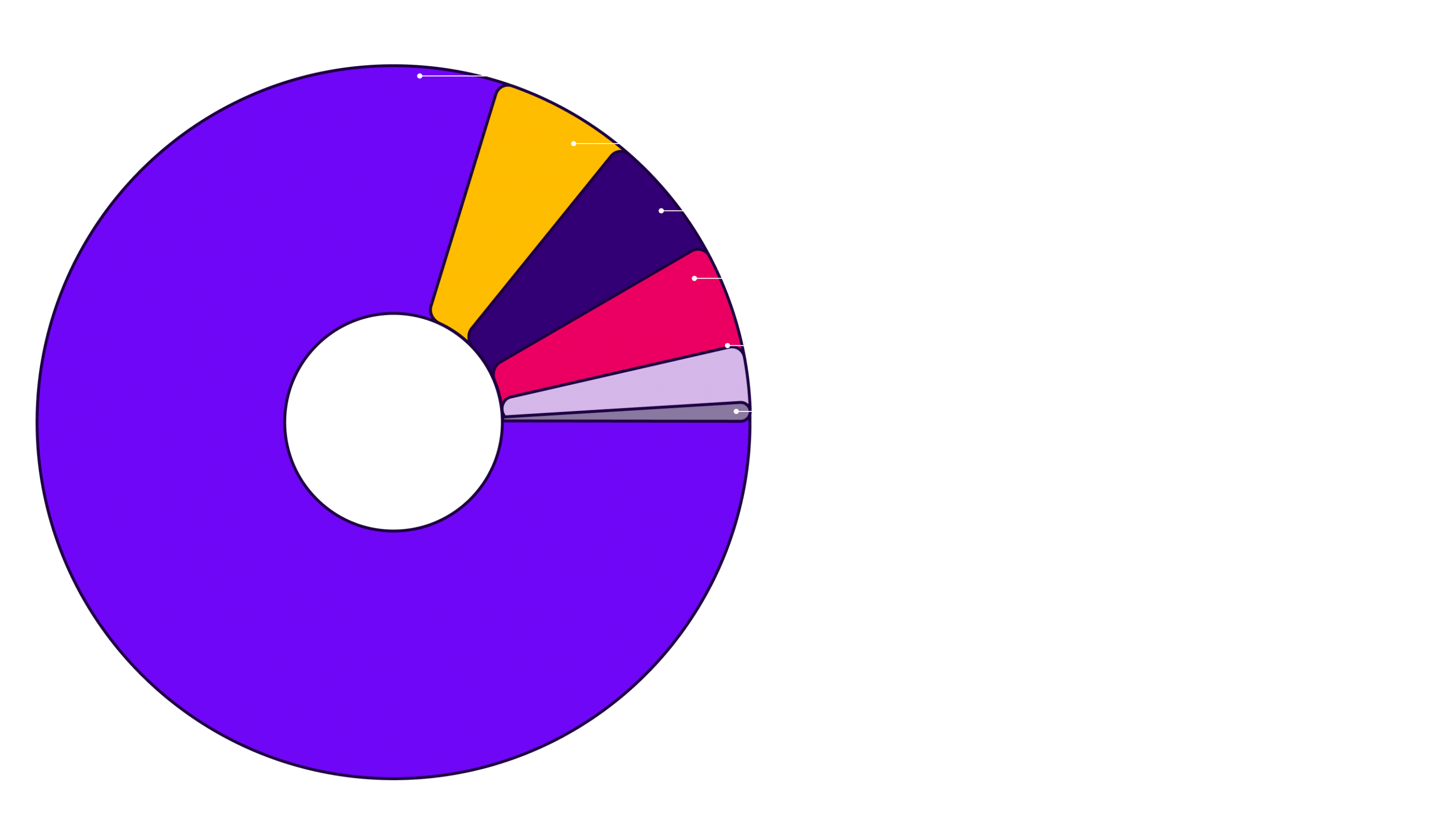

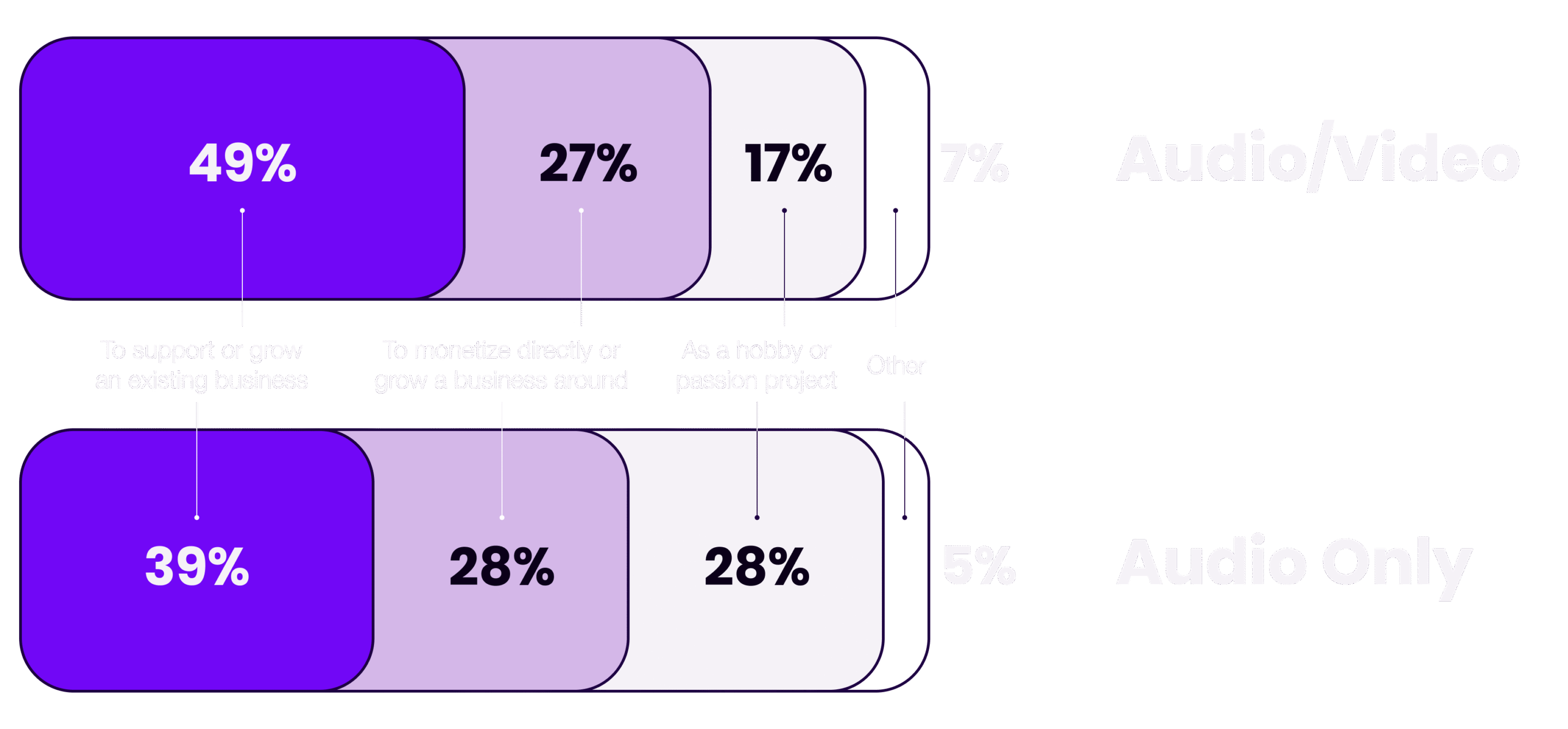

Show Purpose

Key Takeaway

Here we have our first hint at a theme (and question) that runs throughout this report:

Does embracing video lead to a more successful show?

Or is it simply the next frontier to be tackled by shows that are already successful and have resources to reinvest in expanding into new channels and the opportunities they represent?

We can see here that video podcasts have been embraced most by shows that exist to support or grow existing businesses, and least by shows started as a hobby or passion project.

But what drives this difference in adoption rates?

One answer is that shows that exist as marketing channels for businesses face more pressure for the shows to work (ie. attract audiences and buyers), incentivizing them to go where their audiences are to generate ROI and justify their continued existence.

Hobby shows, on the other hand, don’t need audiences to justify their existence. As long as the creator is happy making the show, the show is a success after all.

Another answer may be that the creators of shows that exist to serve businesses are less attached to any one medium and are happy to learn new skills and platforms as trends and expectations change.

This theory highlights a key difference in how many respondents see themselves:

Many of those who use their podcasts as marketing channels for their business would not describe themselves as “Podcasters”… despite in many cases having podcasted for many years and enjoying the creative process of podcasting as much as anyone else does.

These respondents are more likely to identify as “Founders”, “Entrepreneurs”, “Business Owners”, or platform-agnostic “Creators”, who are eager and willing to move between mediums and platforms.

For these respondents, their show is not their singular creative focus, but one of many channels they’re active on, which all exist to serve the business itself.

With this in mind, it’s clear that not only do these podcast creators have logical incentives to be regularly experimenting with new platforms and mediums, the long-term success of their businesses require it.

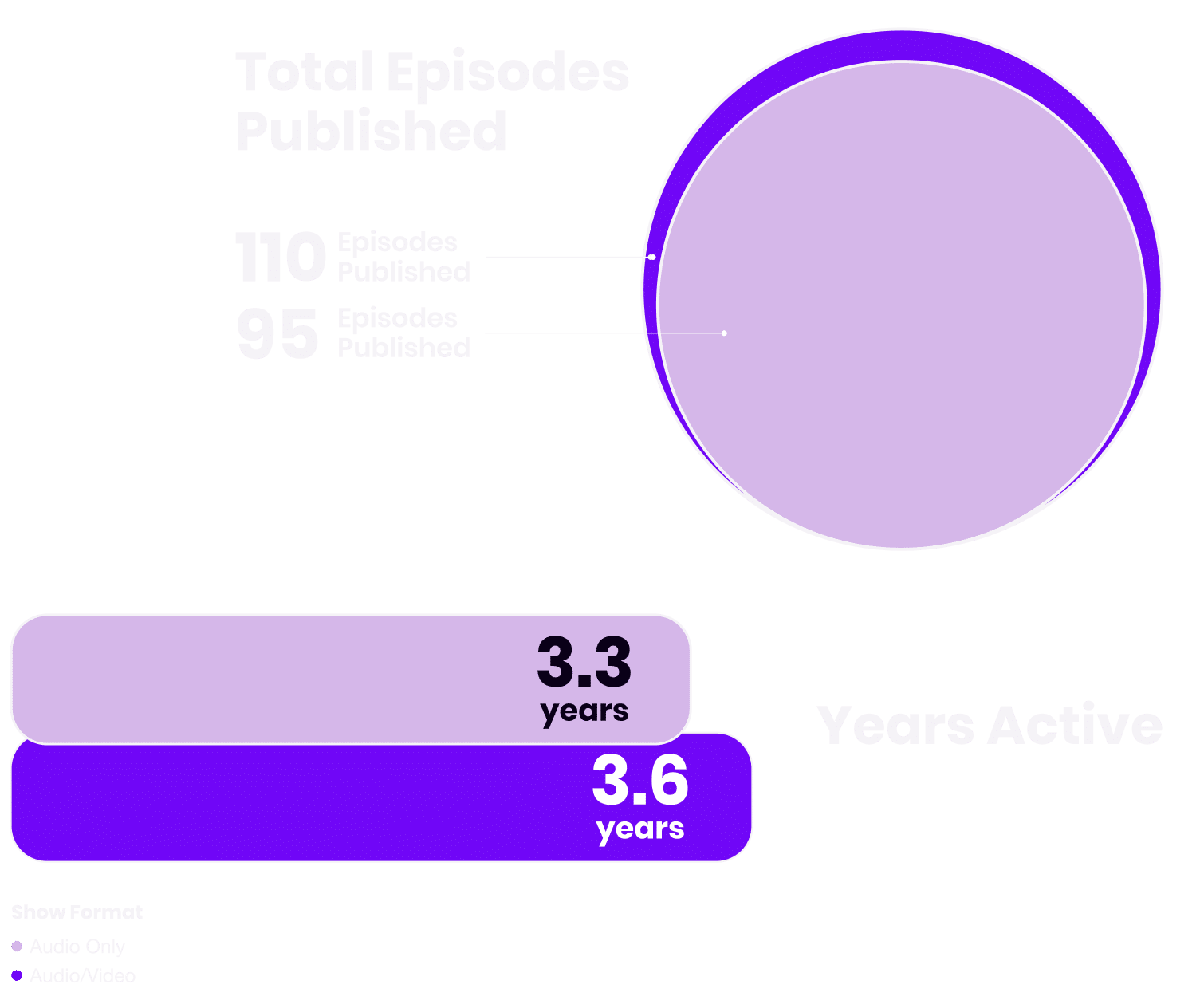

Podcasting Experience

Stop Guessing. Start Growing.

This report is just the start. Sign up to get a steady stream of (often unorthodox) podcast growth & marketing ideas through our Scrappy Podcasting Newsletter.

02

Inputs & Investment

Before we explore the difference in outcomes between Audio-Only and Audio/Video show creators, it’s worth looking at some of the underlying inputs, benchmarks, and resources available to each group.

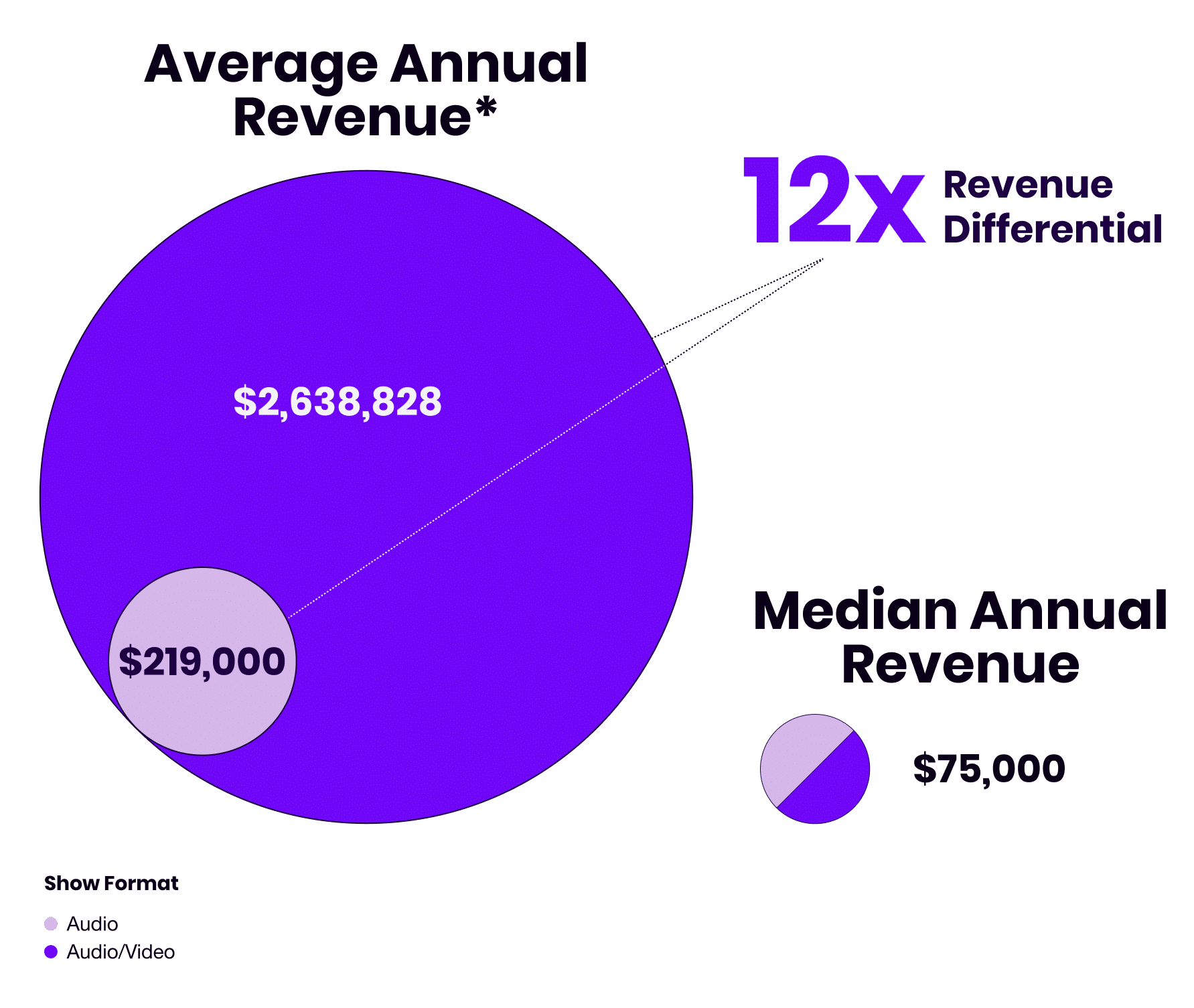

Annual Revenue By Format

* Each show format had one outlier respondent that generated $100M+ in revenue last year. These two shows were removed from this graph to more accurately reflect the average revenues of each show format category.

Key Takeaway

Given the additional costs that often accompany video podcasting, it’s no surprise to see that video shows tend to be produced by creators with significantly higher annual revenues.

That said, the median annual revenue for both groups of creators was identical, with the difference in the Audio/Video group being inflated by the top earners.

For reference, 20% of Audio/Video creators made more than $1M in revenue in 2024, compared with just 4% of Audio Only creators.

But to return again to one of our central questions:

Is this revenue differential the result of embracing video? Or did it pre-date and enable the expansion to video?

While we can’t share the details of the creators publicly, our internal analysis of the respondents shows and businesses suggests that most of these creators already had substantial revenue and audiences before moving to video.

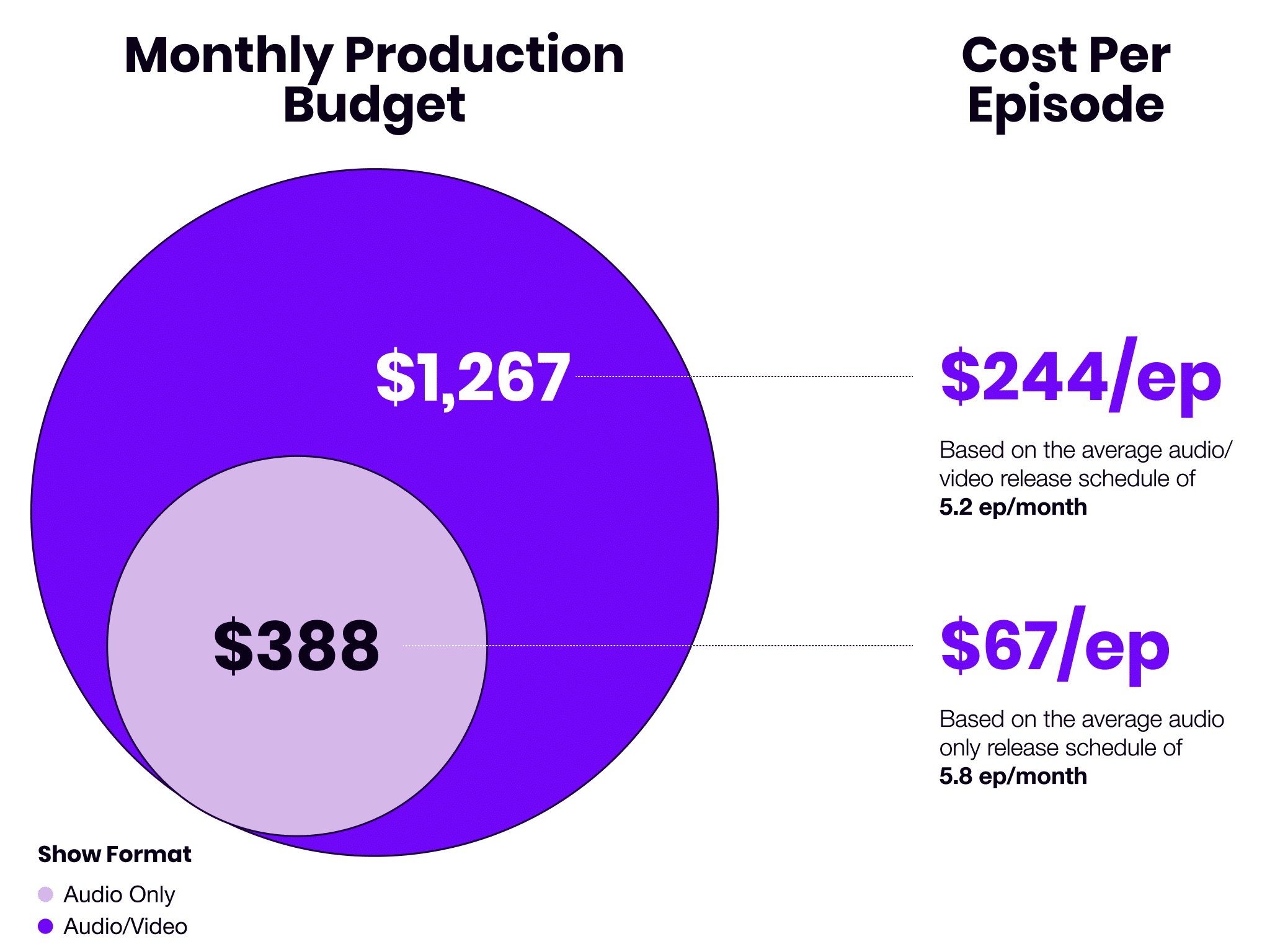

Average Production Budget By Podcast Format

3.6x

Higher cost per audio/video episode than audio-only

Key Takeaway

As with the annual revenue comparison, the median monthly production budget was identical for both groups, at $300/mo.

That said, even the average budgets for both groups are surprisingly low.

It’s worth noting, however that for audio/video shows generating more than 10k views per month on YouTube, the average production budget was significantly higher at $3,303/month.

By comparison, the audio-only shows averaging 10k plays per month had an average budget of $922/month.

In an interesting quirk, that differential between the top-performing shows in each group is identical to the overall production budget differential: 3.6x more for audio/video shows than audio-only.

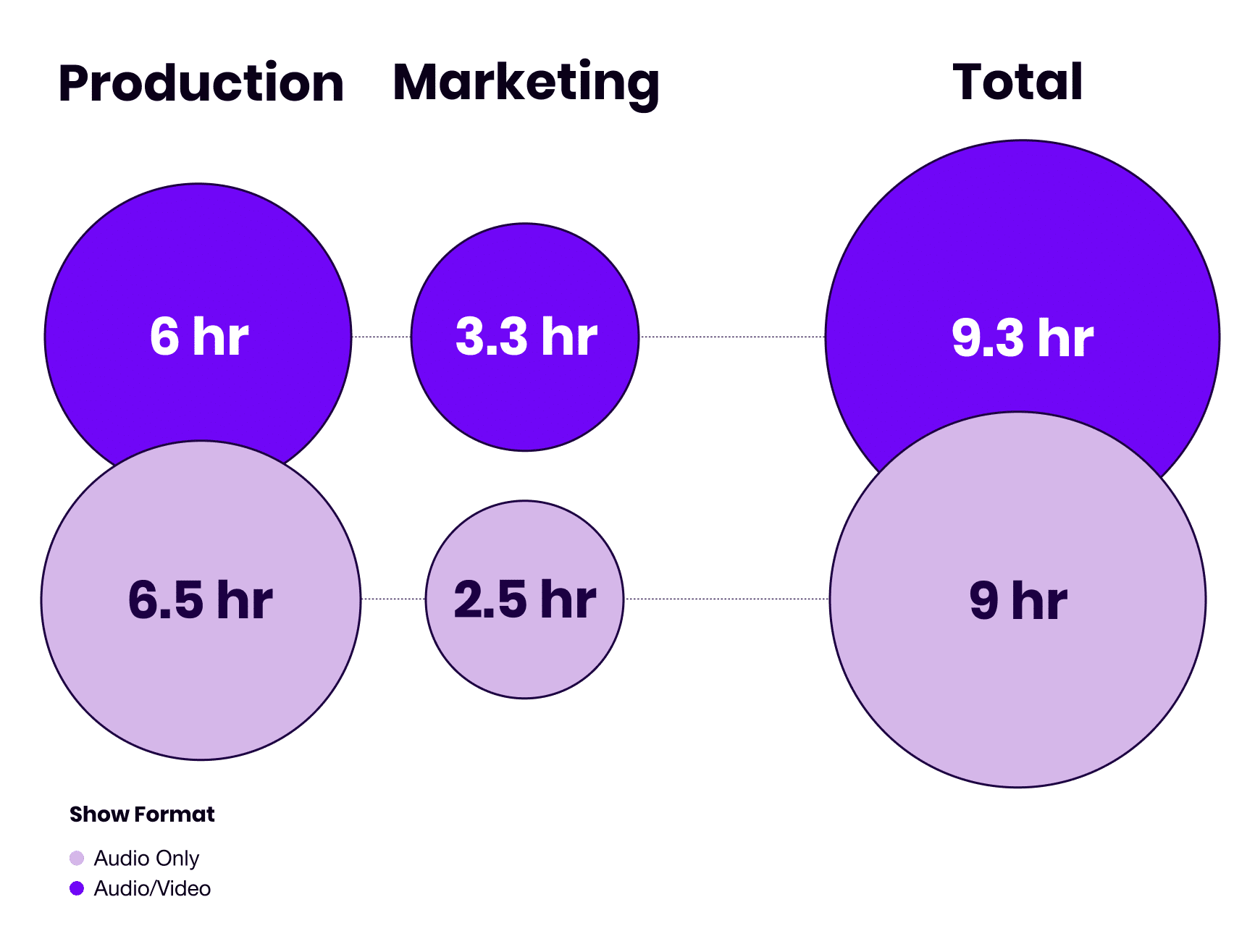

How Much Time do Video Podcasters Spend Per Week vs Audio-Only Podcasters?

Key Takeaway

Anyone who’s produced a video podcast can tell you that compared to an audio-only show, everything—from set up to editing to episode packaging to uploading to additional platforms—takes longer.

It’s surprising, perhaps even shocking, then to see that our Audio/Video respondents spend less time on production than Audio-Only shows.

That is, until you take a look at closer look at the following section detailing the additional support the typical host in each category has from their team.

Comparing the Average Team Size Between Video Podcast & Audio-Only Podcasts?

Full Time Employees

63%

More support for Audio/Video shows vs Audio-Only

Audio-Only Avg: 0.8

Audio/Video Avg: 1.3

Part Time Employees

29%

More support for Audio/Video shows vs Audio-Only

Audio-Only Avg: 0.7

Audio/Video Avg: 0.9

Contractors

15%

More support for Audio-Only shows vs Audio/Video shows.

Audio-Only Avg: 1.5

Audio/Video Avg: 1.3

Agencies

600%

More support for Audio/Video shows vs Audio-Only

Audio-Only Avg: 0.1

Audio/Video Avg: 0.6

Paid Podcast Growth: Money Pit or Growth Hack?

What Everyone’s Getting Wrong About Video

This Obscure Marketing Theory Explains Why Podcasts Grow

03

The Outcomes of Audio vs Video Podcasting

With a better understanding of who is creating each type of show and the resources they have at their disposal, it’s time to explore the difference in outcomes for each format.

Percent of Sales Attributable to Podcast for Audio vs. Video Shows

Key Takeaway

When asked what percentage of buyers engaged with their podcasts before purchasing, respondents who produced Audio-Only shows reported a higher percentage of sales attributed to the podcast.

One explanation for the gap could be that (as we’ll see shortly) the creators of Audio/Video podcasts tend to have more reach across almost every platform they’re active on than they’re Audio-Only counterparts.

With that in mind, it’s possible—indeed likely—that they simply have more roads leading back to their products and services, with sales attribution spread more broadly across the channels they’re active on.

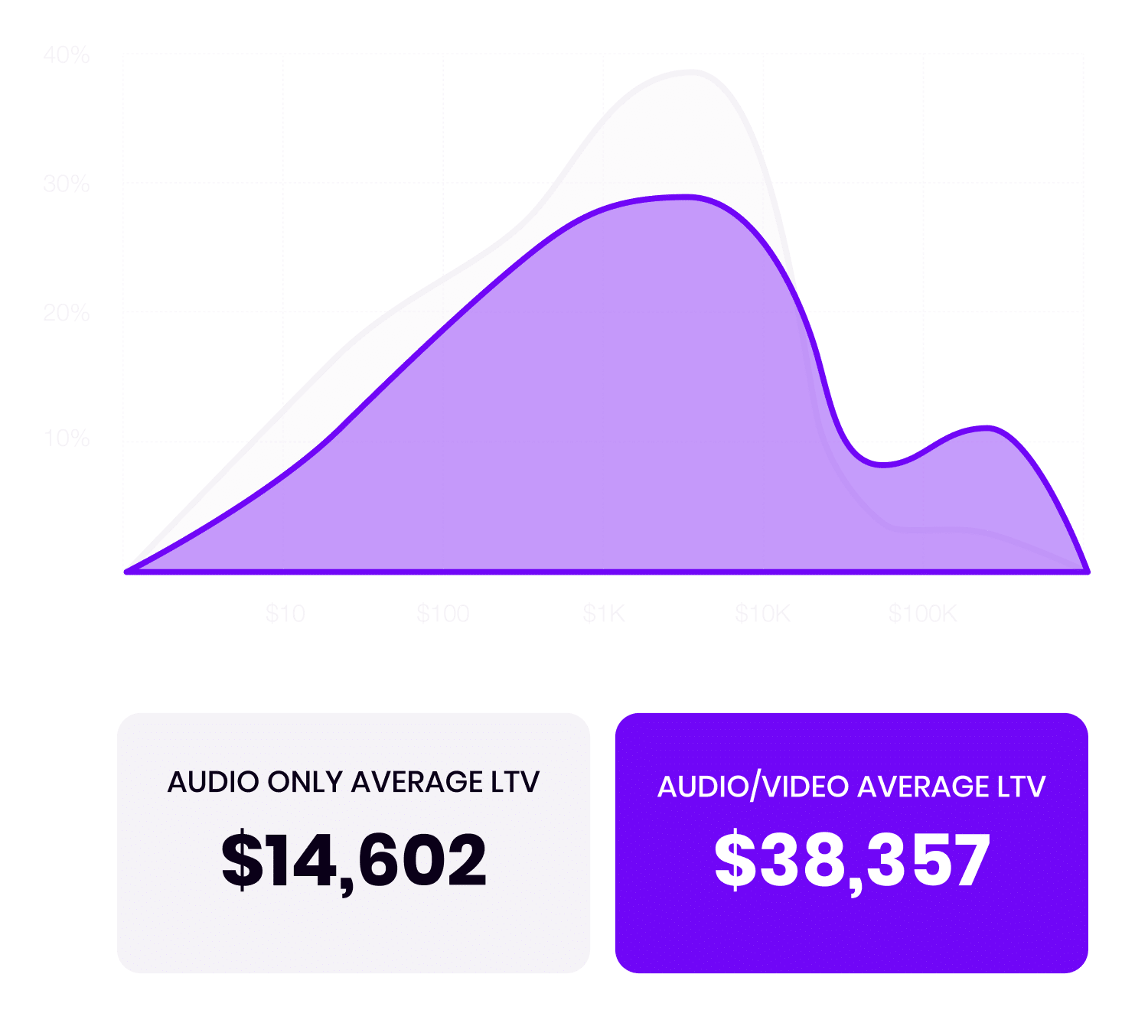

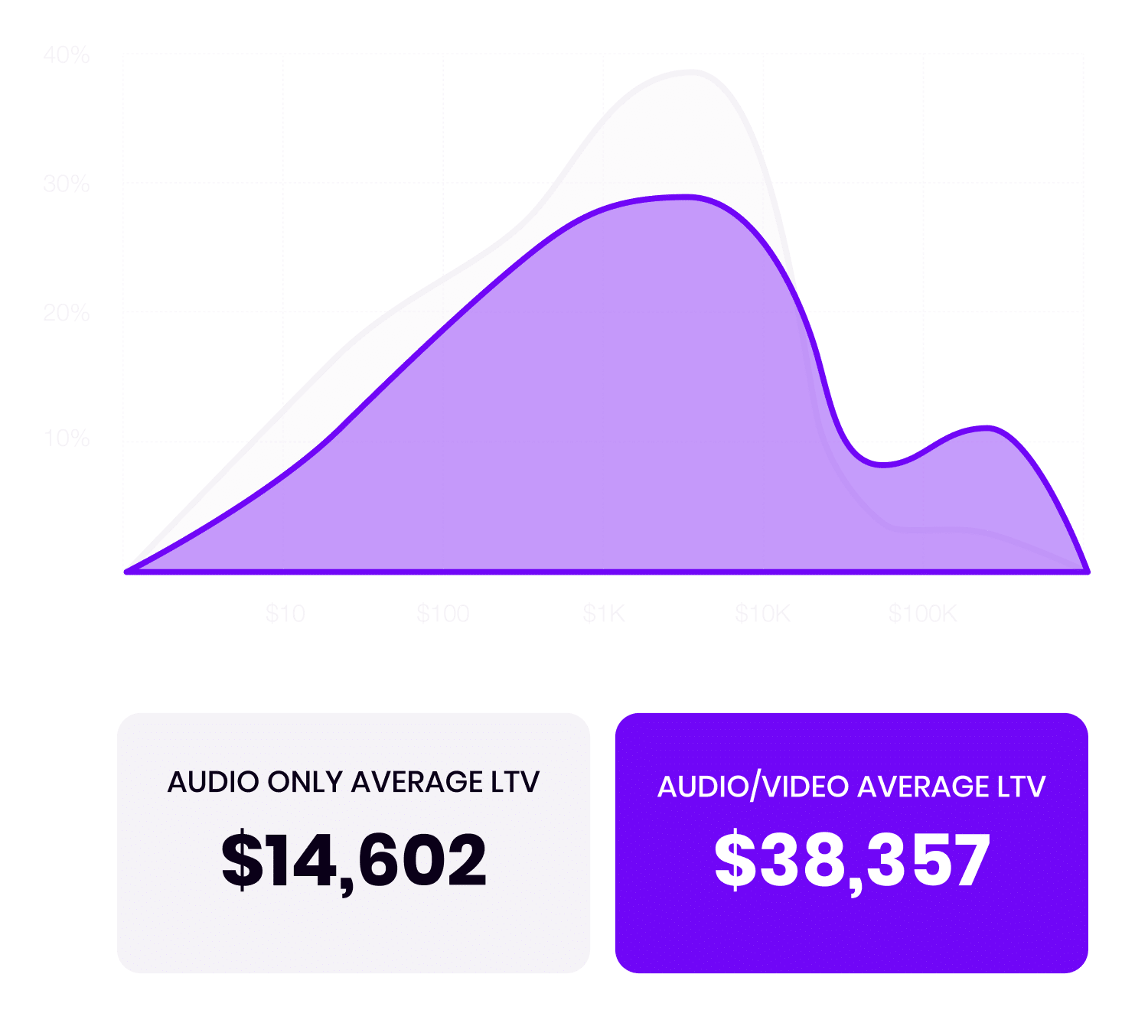

Average Lifetime Value Per Customer for Audio vs Video Podcasts

Key Takeaway

Yet again, we have two different stories told by two different ways of interpreting the data.

The mean Average Lifetime Customer Value for each group is starkly different, with Audio/Video podcasters raking in 2.6x more per customer than Audio-Only shows.

The median Average LTV for each group, however, is once again identical, at $3,500/customer.

This data reinforces our long-held belief that podcasts are best used as marketing tools for businesses with expensive products that rely on trust rather than scale.

Key Takeaway

Yet again, we have two different stories told by two different ways of interpreting the data.

The mean Average Lifetime Customer Value for each group is starkly different, with Audio/Video podcasters raking in 2.6x more per customer than Audio-Only shows.

The median Average LTV for each group, however, is once again identical, at $3,500/customer.

This data reinforces our long-held belief that podcasts are best used as marketing tools for businesses with expensive products that rely on trust rather than scale.

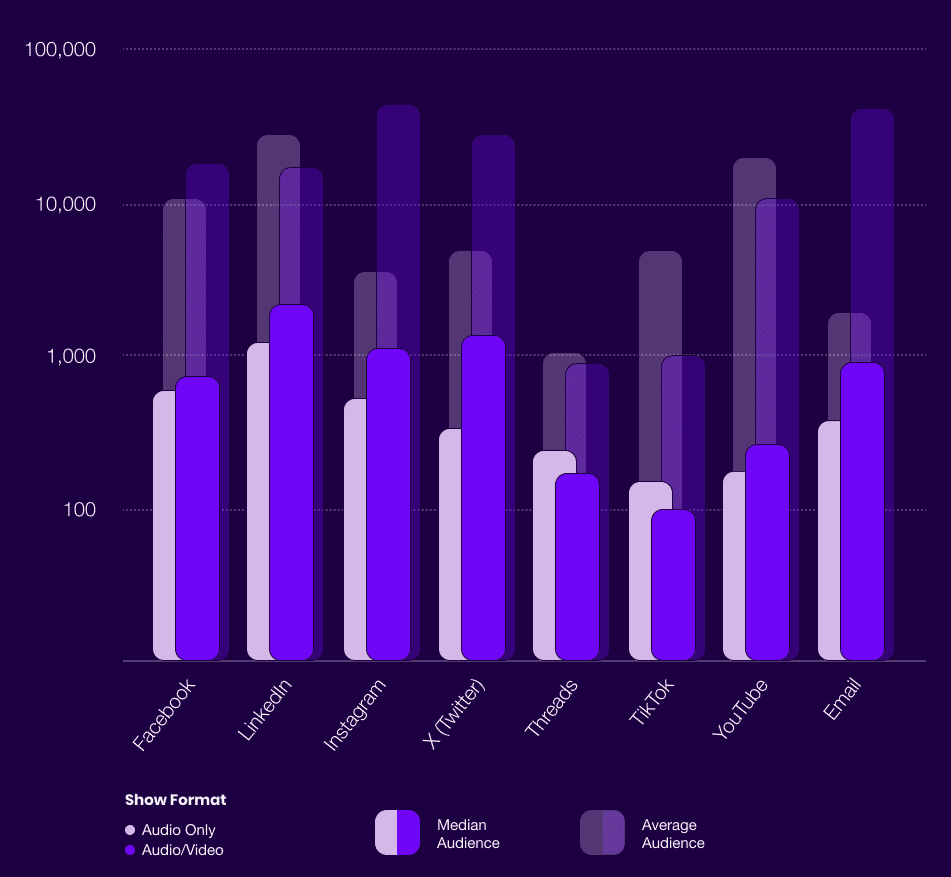

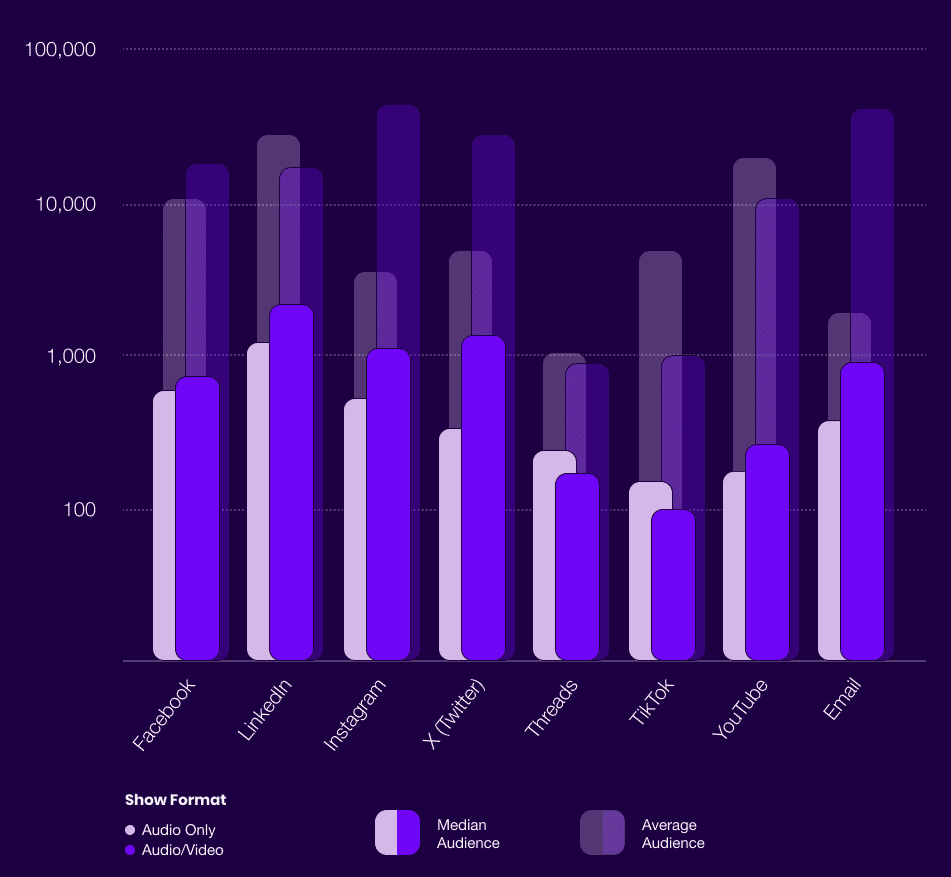

Median Cross-Platform Audience Sizes for Audio & Video Podcasts

Key Takeaway

While the median audience size numbers are similar enough across various non-podcast platforms, Audio/Video creators tend to have larger audiences on all but two platforms, Threads, and TikTok.

When we look at the data in terms of average audience size (instead of median), we see another side to the story.

For one, Audio/Video creators exhibit massively larger audiences on several platforms, including email subscribers, X, and Instagram.

On the other side, Audio-Only podcasters boast larger average audience sizes on half of the platforms we surveyed them on, including, ironically, YouTube.

Key Takeaway

While the median audience size numbers are similar enough across various non-podcast platforms, Audio/Video creators tend to have larger audiences on all but two platforms, Threads, and TikTok.

When we look at the data in terms of average audience size (instead of median), we see another side to the story.

For one, Audio/Video creators exhibit massively larger audiences on several platforms, including email subscribers, X, and Instagram.

On the other side, Audio-Only podcasters boast larger average audience sizes on half of the platforms we surveyed them on, including, ironically, YouTube.

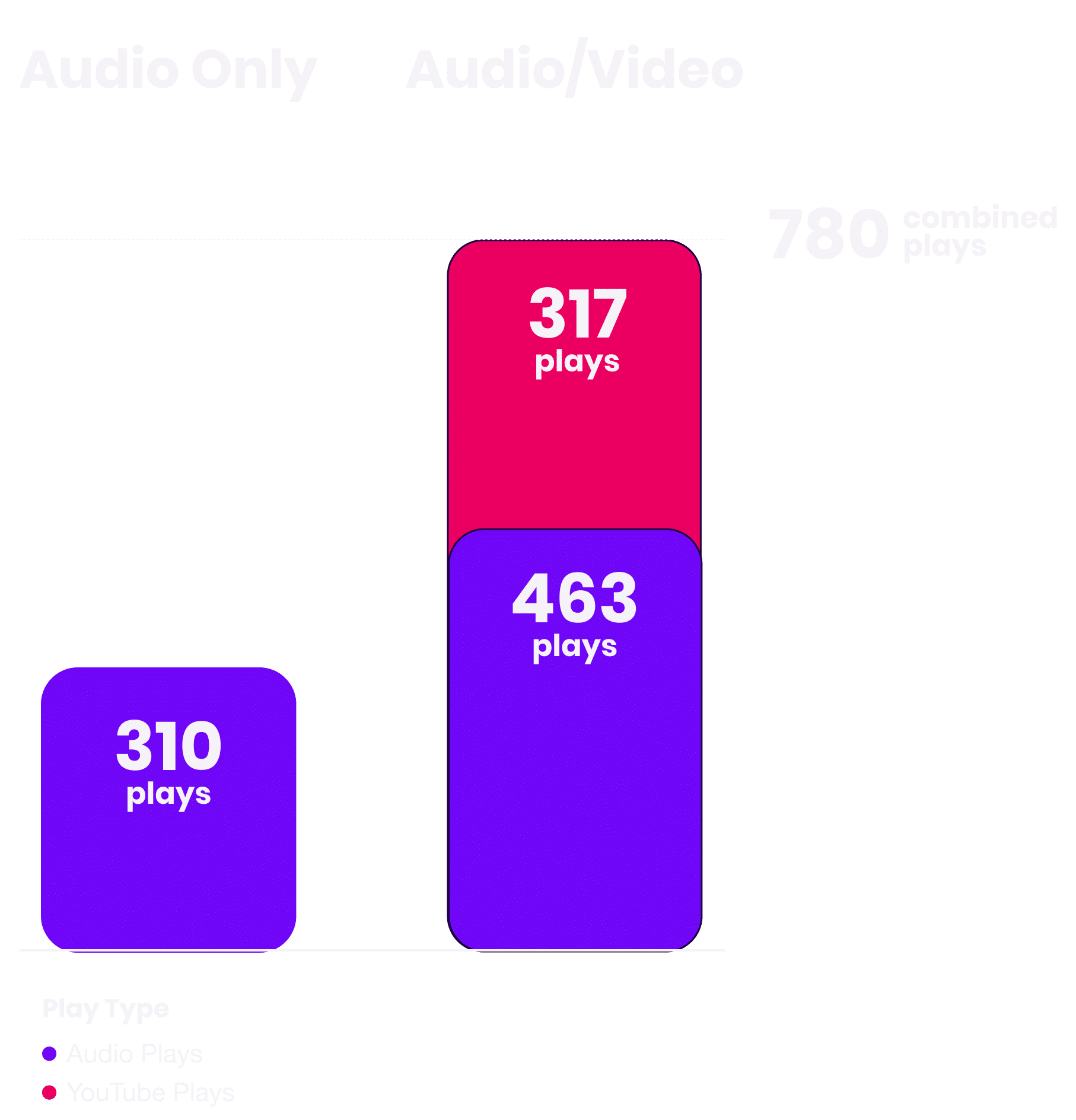

Audio Only vs Video Podcast Median Plays Per Episode

Key Takeaway

One concern of many Audio-Only podcasters is that expanding into video will cannibalize their audio podcast listeners… potentially losing out on ad revenue in the process.

In our experience, however, it’s worth thinking of audio and video podcast consumers as distinct groups with limited overlap in consumption habits.

In other words, “YouTube Viewers” are likely to consume a show on YouTube and “Audio Podcast Listeners” are likely to consume your show via podcast apps.

In the end, as our respondents’ data shows, these platforms tend to be additive, opening shows up to new audience members, many of whom would not otherwise consume the show, even if they were already aware of it.

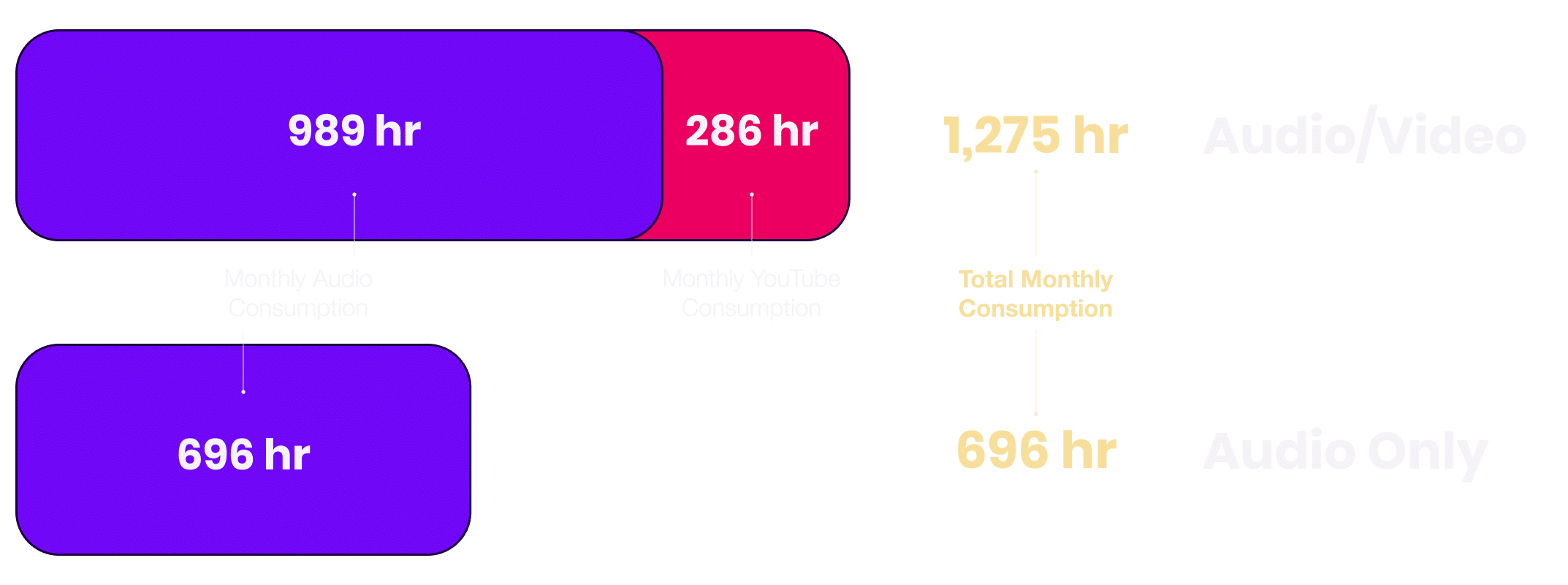

Monthly Consumption Time for Audio Only vs Video Podcasts

When it comes to podcast consumption, total cross-platform plays are only part of the story.

To fully understand the benefits and drawbacks of Audio/Video and Audio-Only podcasts, we need to take a closer look at the differences, both in how creators produce shows for each platform as well as how consumers engage with them.

Audio-Only vs Audio Video Podcast Benchmarks

Avg. Episode Duration

🎙️ Audio Only

35.2 min

📹 Audio/Video

40.4 min

Avg. Completion Rate

🎙️ Audio Only

66%

📹 Audio/Video

61%

Avg. Episodes/Month

🎙️ Audio Only

5.8

📹 Audio/Video

5.2

By combining these benchmarks with our previously established play-counts, we get a clear picture of the average monthly consumption time for each show format.

Key Takeaway

It’s clear that despite its historic drawbacks when it comes to discoverability, audio is a powerful tool for maintaining attention once it’s been acquired.

So what does that mean for your decision to pursue (or continue to pursue) video or not?

For one, the additional 286 hours of video consumption time (on average) is not nothing. In fact, for the Audio-Only shows, that additional time would account for a 41% increase in overall consumption.

In addition to the additional video consumption time, however, the Audio/Video shows also earn 49% more audio plays and 42% more audio consumption time than Audio-Only shows.

Of course, we can’t say that this consumption differential is the direct result of producing a video show and publishing it to YouTube.

But we will offer a pair of hypotheses, starting with the boring one:

Some people do, in fact, discover shows on YouTube and ultimately opt to listen to the show via a podcast app.

While many YouTube consumers have never opened up a podcast app, nearly all audio podcast consumers do use YouTube regularly—even if not to consume podcasts.

Given YouTube’s strength at (and explicit goal of) matching users with content they’ll like, it’s almost inevitable that the platform will occasionally (or regularly) introduce audio podcast listeners to new creators and shows they will enjoy.

Now, the more interesting (and impossible to prove) hypothesis:

Compared to podcasting, YouTube is both a much more transparent and much more competitive platform.

What this means is that creators (more or less) know how “the game” of the YouTube algorithm works, and are highly incentivized to develop the skills necessary to master it.

In practice, that means improving their episode titles, packaging, hooks, pacing, storytelling, and more, in service of improving the metrics that YouTube’s algorithm uses to promote videos.

Of course, as they improve these skills, they improve their results on YouTube.

But is it not reasonable to expect that better titles, packaging, hooks, pacing, and storytelling—ie. better content—would also improve their ability to attract and retain listeners on their audio-only feeds?

It may be hard to prove. But it’s something to consider.

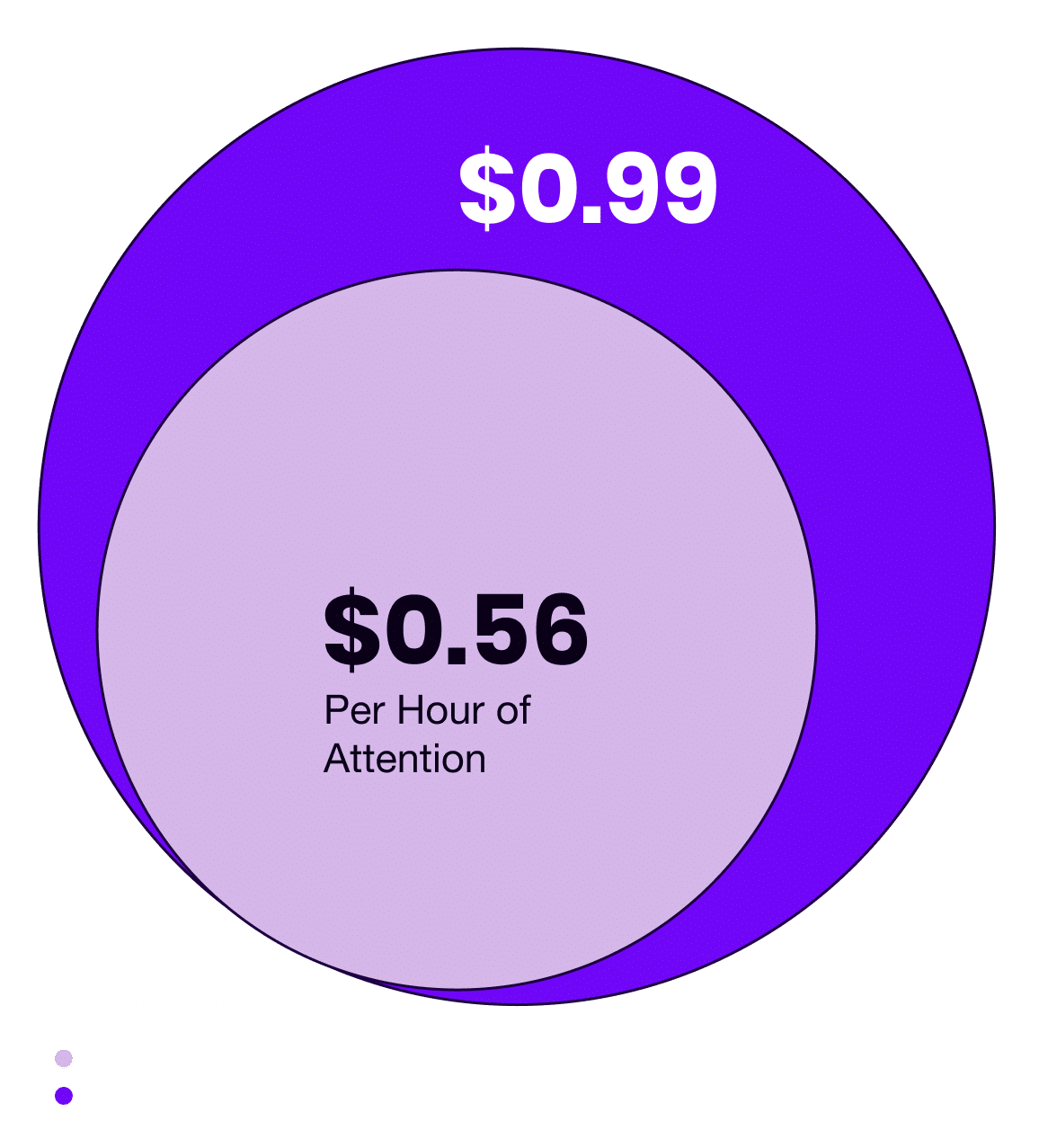

The Cost Per Hour of Attention for Audio-Only vs Video Podcasts

And while there are many reasons to choose either format, many specific to each creator or brand, we wanted to round out the report by synthesizing all the data we’ve uncovered into a single metric that can be used to assess the value of producing each type of show:

Cost per hour of attention.

This metric accounts for the differences in cost, publish schedule, and total consumption time to provide a side-by-side assessment of the ROI of Audio-Only Podcasts vs the ROI of Audio/Video Podcasts.

Key Takeaway

Throughout this report, we’ve seen how shows that produce both audio and video versions of their shows have performed better in nearly every category of outcome that creators care about.

And yet, once we accounted for the additional cost of producing video, the difference in the ROI in terms of audience attention is stark, with Audio/Video shows costing 77% more per hour of audience attention than their Audio-Only counterparts.

Take from this what you will, but we see it as a strong sign that there is still plenty of use, opportunity, and value in producing Audio-Only shows.

Of course, as this report has shown, there is also plenty of reason to produce shows that function on both audio and video platforms, especially for creators and brands with the budget to do video well.

In the end, there is no one “right” answer to which format is right for you.

Each has its benefits. Each has its drawbacks.

It’s up to you to decide which format is right for you.

Stop Guessing. Start Growing.

This report is just the start. Sign up to get a steady stream of (often unorthodox) podcast growth & marketing ideas through our Scrappy Podcasting Newsletter.

Presented By

With Support From

04

Additional Podcast Marketing Resources

More Data-Driven Insights

Decode The Spotify Discovery Algorithm

The Spotify algorithm is one of the best ways to increase your exposure. But it’s also an incredible tool to help diagnose issues that are keeping you from more listeners on every platform.

Learn what the data says and how to leverage Spotify’s tools to grow faster.

Read Our In Depth Guides

The 4 Phases of Podcast Growth

If your marketing isn’t working, there’s a good chance it’s because you’re using the wrong tactics for the phase of growth you’re in. Here’s how to use the right marketing strategy at the right time

How to Become A Better Podcast Interviewer

A practical guide to improving your interviews, episodes, and guest relationships using the hidden skills, traits & practices behind truly great guest interviews.

The Definitive Guide to Podcast Hooks

The dark art & curious science of crafting a podcast that worms its way into your listeners’ minds and refuses to leave.

Subscribe To Our Free Content

Daily Podcast Marketing Micro Lessons

A daily newsletter breaking down the mechanics and the magic of making and marketing podcasts that grow, sell, and resonate.

Data-Driven Podcast Marketing Insights

Exploring the data behind the biggest and fastest growing shows to help you make better, smarter, more effective marketing decisions for your show.

Work With Us

A Step-by-Step Playbook to Your First 500 Podcast Subscribers

First500 is a self-paced video course and playbook walking you through the single hardest phase of podcast marketing: Gaining initial traction.

First500 Is Designed For:

- Established shows that have hit a plateau at fewer than 500 downloads per episode

- New shows that are looking to develop their ongoing post-launch marketing strategy

- Hosts who are new to—or intimidated by—marketing and looking for a straightforward, easy-to-follow playbook to get started

- Business owners, creators, and podcast managers looking for the 80/20 solution to gaining traction without spending hours consuming content.

Personalized, On-Demand Podcast Strategy For Businesses & Pro Creators

The PMA Membership gives you on-demand access to everything you need to grow your show, including personalized strategy & feedback, 100+ hours of podcast marketing training, dozens of step-by-step marketing playbooks, weekly coaching calls, a community of growth-oriented podcasters, and more.

The PMA Membership Is Designed For:

- Experienced business owners, professional creators, marketers, and podcast professionals looking for ongoing personalized marketing support

- Established shows that have been podcasting for at least a year and are looking to accelerate growth

- Brands & business owners looking to increase client acquisition and podcast-driven revenue

- Hosts looking to build (or grow) a robust cross-channel marketing strategy around podcasting, email, video, social, and more

Or, if you’re feeling especially saucy, you can apply to work with us directly via a personalized podcast audit, custom growth plan, and ongoing 1:1 marketing support.

Special thanks to these creators & shows for generously contributing their monthly download data.