Podcast Marketing Trends 2024 Report

Presented By

In 2024 it’s easier than ever to start, produce, and maintain a podcast.

But growth is harder than ever.

This report is designed to play a small but important role in changing that.

What are the factors that contribute to podcast growth?

This is the guiding question behind this report.

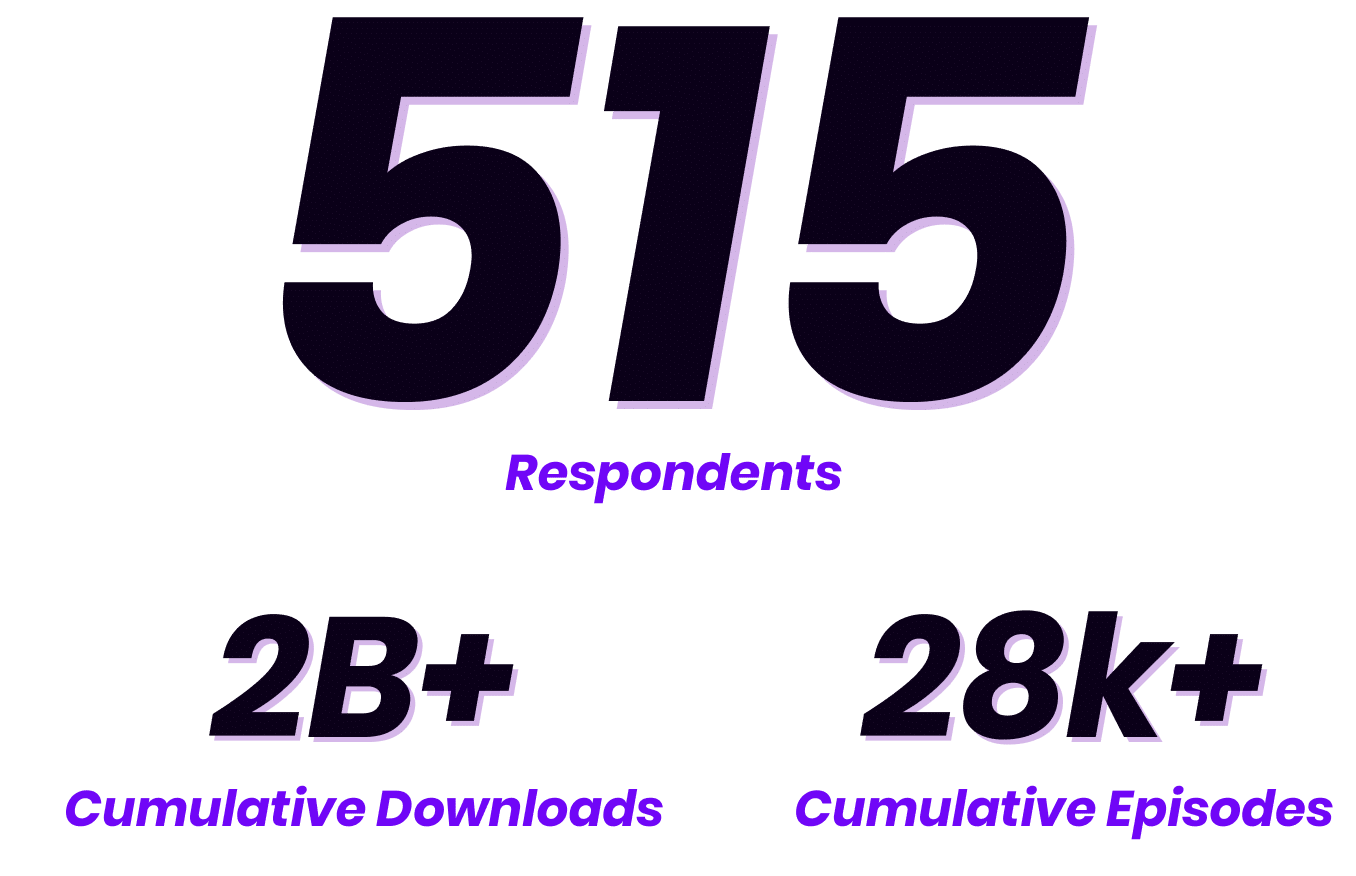

To attempt to answer it, we enlisted the help of 515 podcasters and industry professionals from a diverse set of personal backgrounds, niches, formats, and experiences.

In Q1 of 2024, we asked them to complete a sadistically long and detailed survey, sharing month-by-month episode data, marketing activities, and a whole lot more.

To our delight (and to be honest, a bit of surprise), many were more than happy to do so.

How We Broke Down The Data

High vs Low Growth

Our primary focus this year was to identify the differences between high-growth and low-growth shows—regardless of their size.

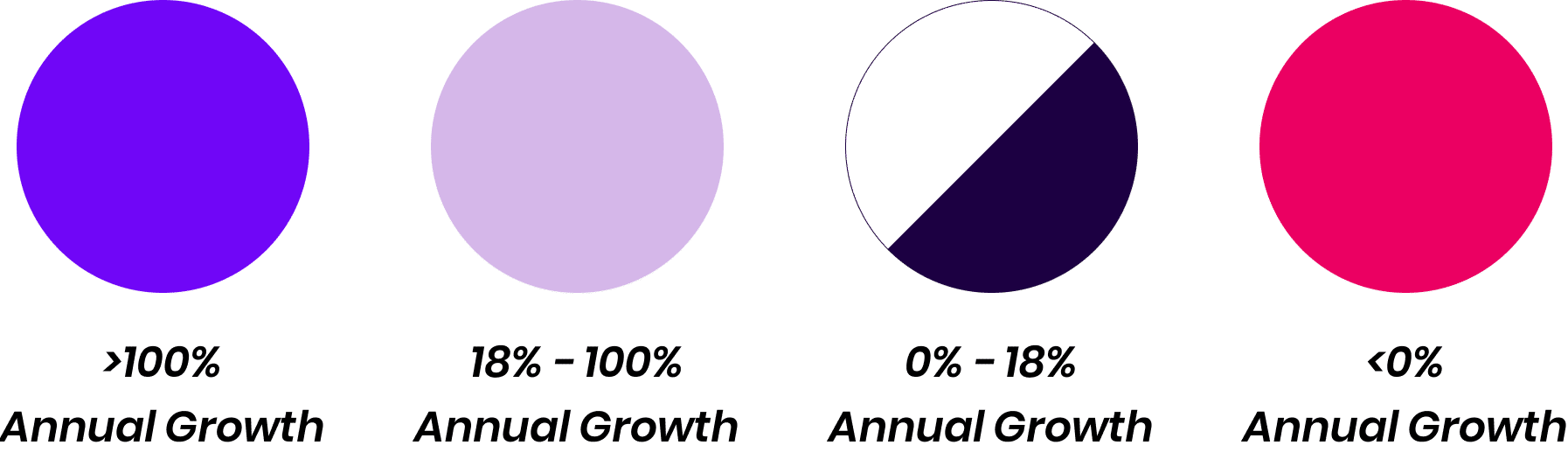

To do this, we divided the responses into four annual growth rate segments based on self-reported download data and cross-analyzed various other data points.

Throughout the report, we’ve represented these 4 distinct groups as follows.

Big vs Small

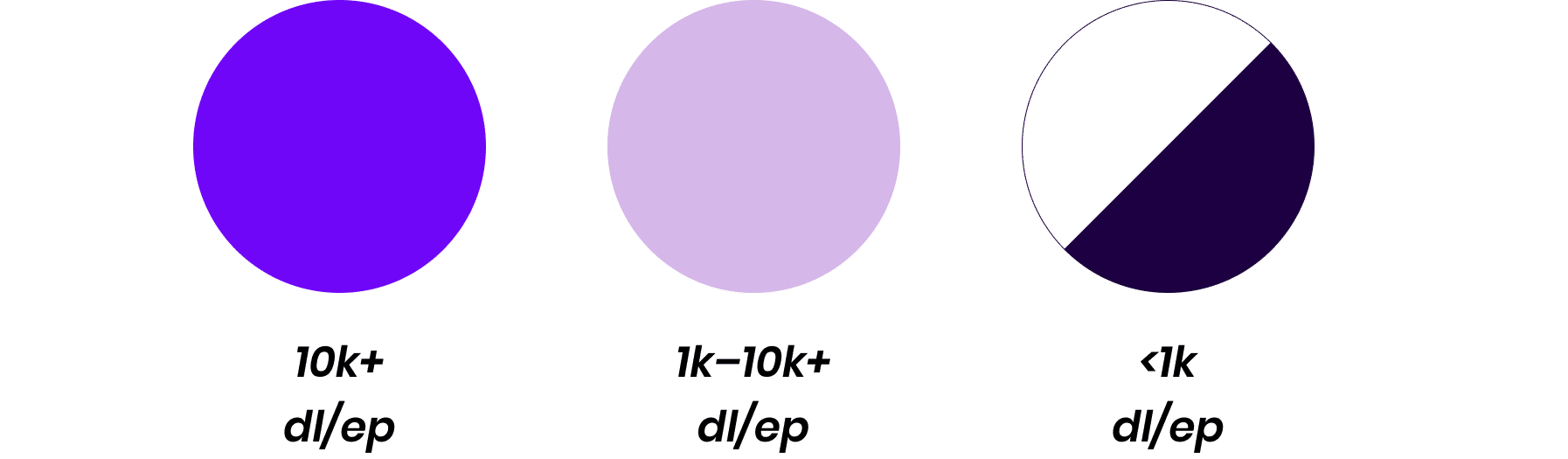

Our secondary comparison was the differences between big shows vs smaller shows.

To do this, we divided the responses into three downloads-per-episode segments based on their self-reported download data and cross-analyze various other data points.

When comparing show size, we’ve represented these 3 groups as follows.

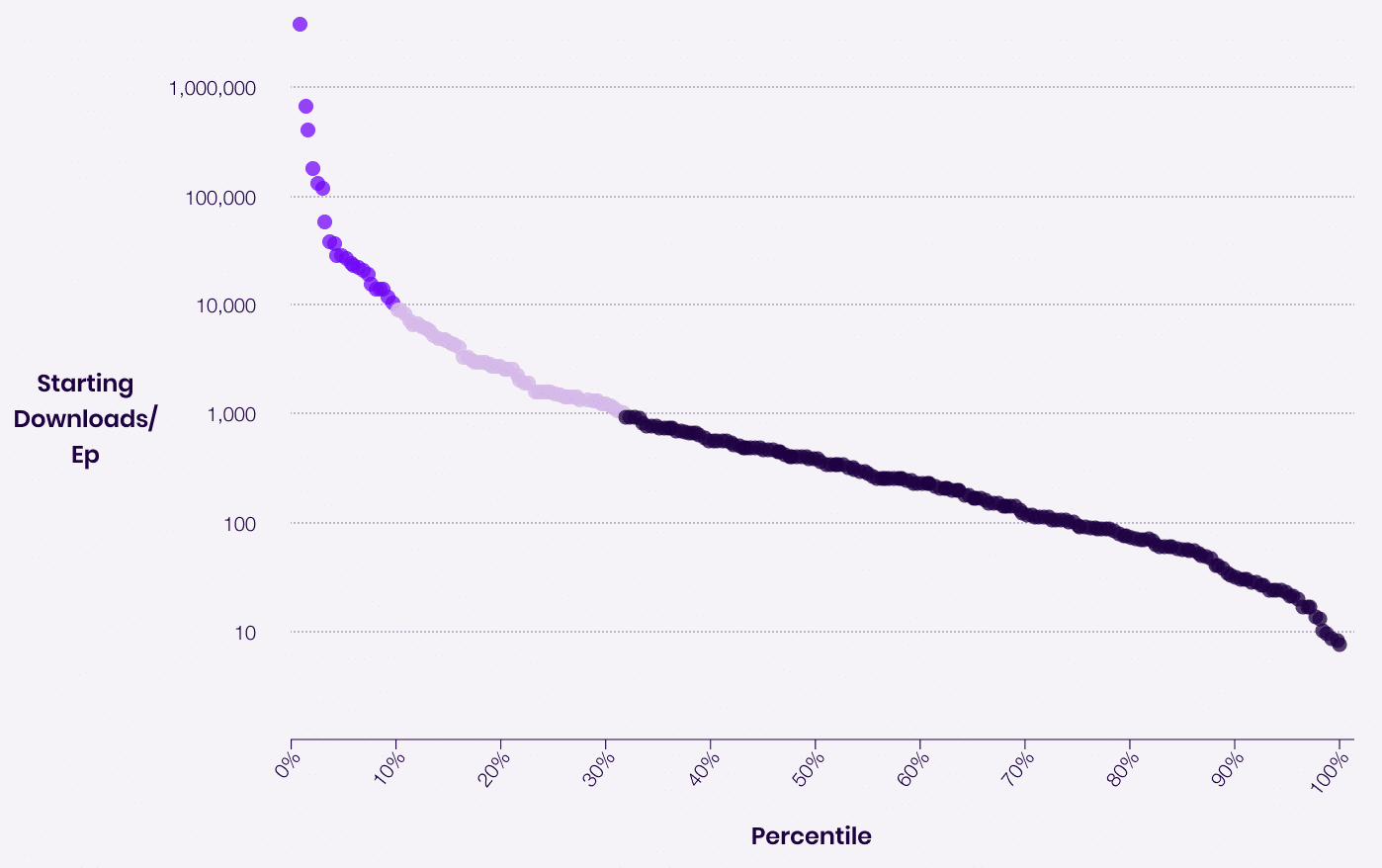

Downloads Per Episode Distribution

Methodology

Growth Rates

The median show at the start of the year had 274 downloads per episode with the median show at the end of the year posting 324 downloads per episode, a growth rate of 18%.

We divided the shows into four segments relative to this median show growth rate, two above and two below, as follows:

High Growth Shows (>100% Growth): Shows that grew by 100% or more, more than doubling in size.

Medium Growth Shows (18–100%): Shows that grew faster than the median show but did not double in size.

Low Growth Shows (0–18% Growth): Shows that grew, but at a pace below the median show.

Negative Growth Shows (<0% Growth): Shows that shrunk in size on a downloads per episode basis.

Downloads Per Episode

We calculated downloads per episode by dividing each show’s total monthly downloads by the number of new episodes they released that month.

While this approach does not account for the impact of back-catalogue downloads, we preferred this rough downloads-per-episode approach over absolute monthly downloads as it better accounts for changes in publishing schedules.

01

About the Respondents

Our respondents offer a nuanced perspective on podcast creation and growth.

Together, they represent 6 continents (sorry Antarctica) and a diversity of languages, show formats, topic categories, reasons for creating, and more.

Here’s a little bit about who they are.

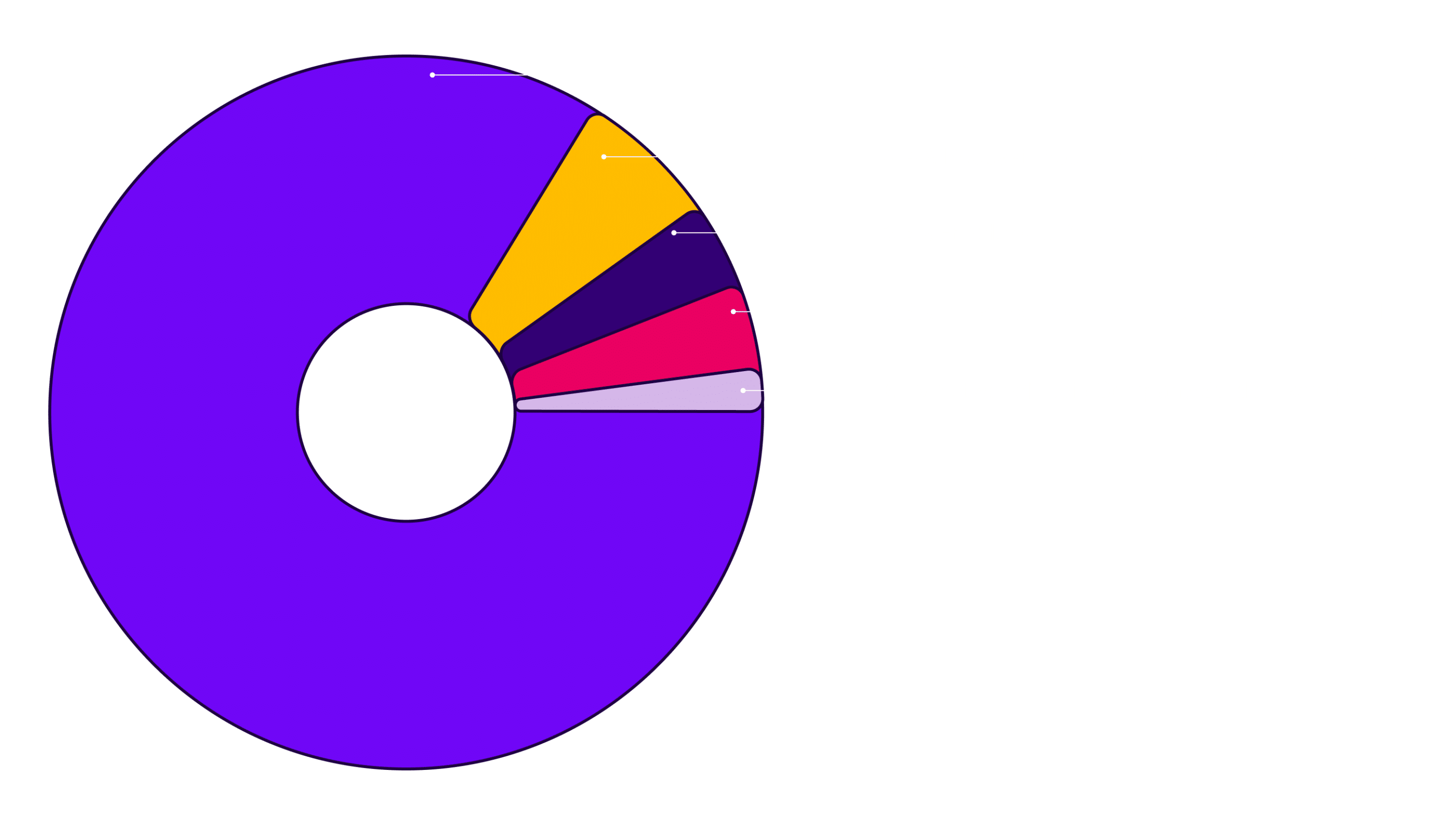

Role In the Podcast Industry

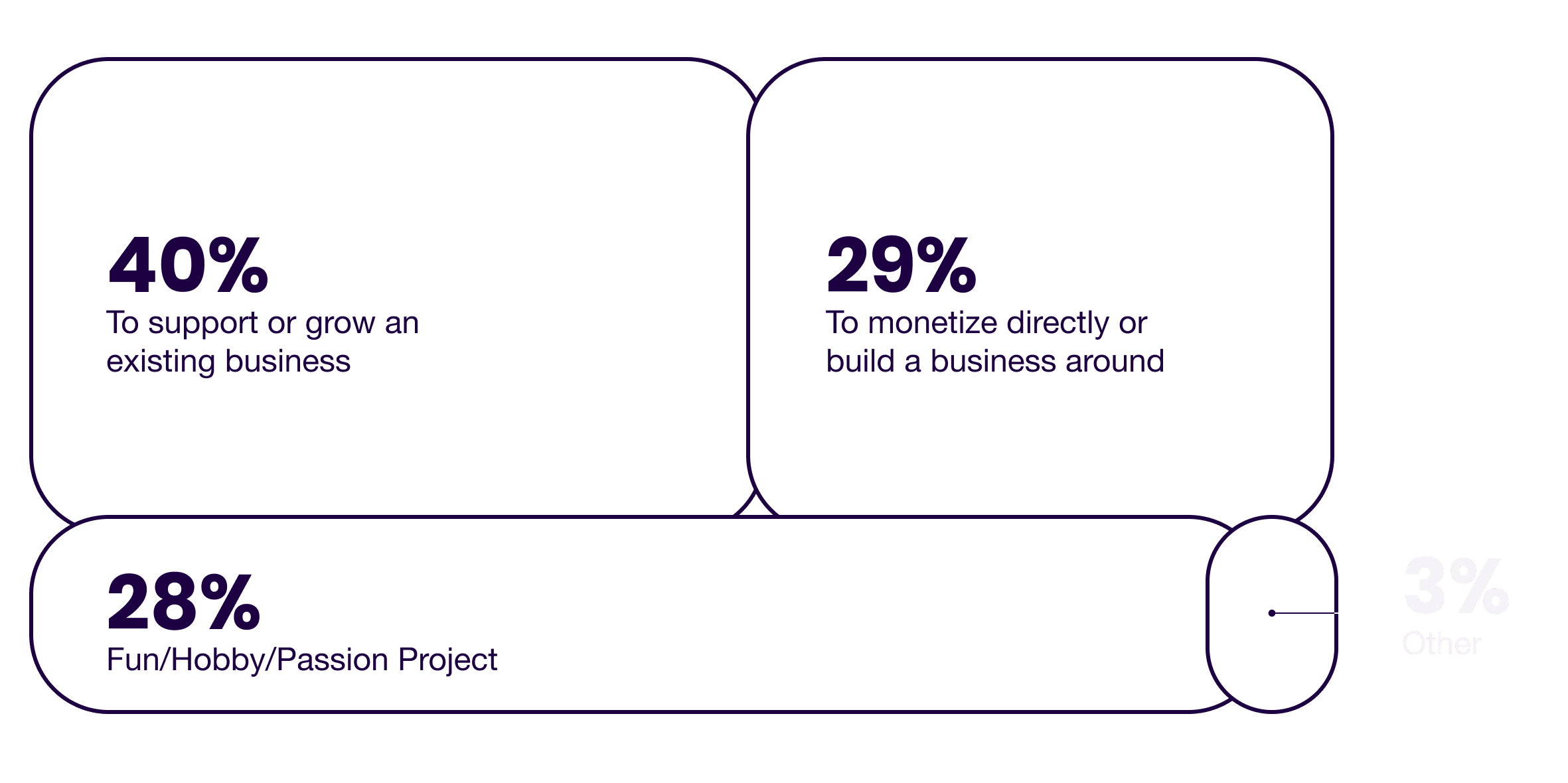

Show Purpose

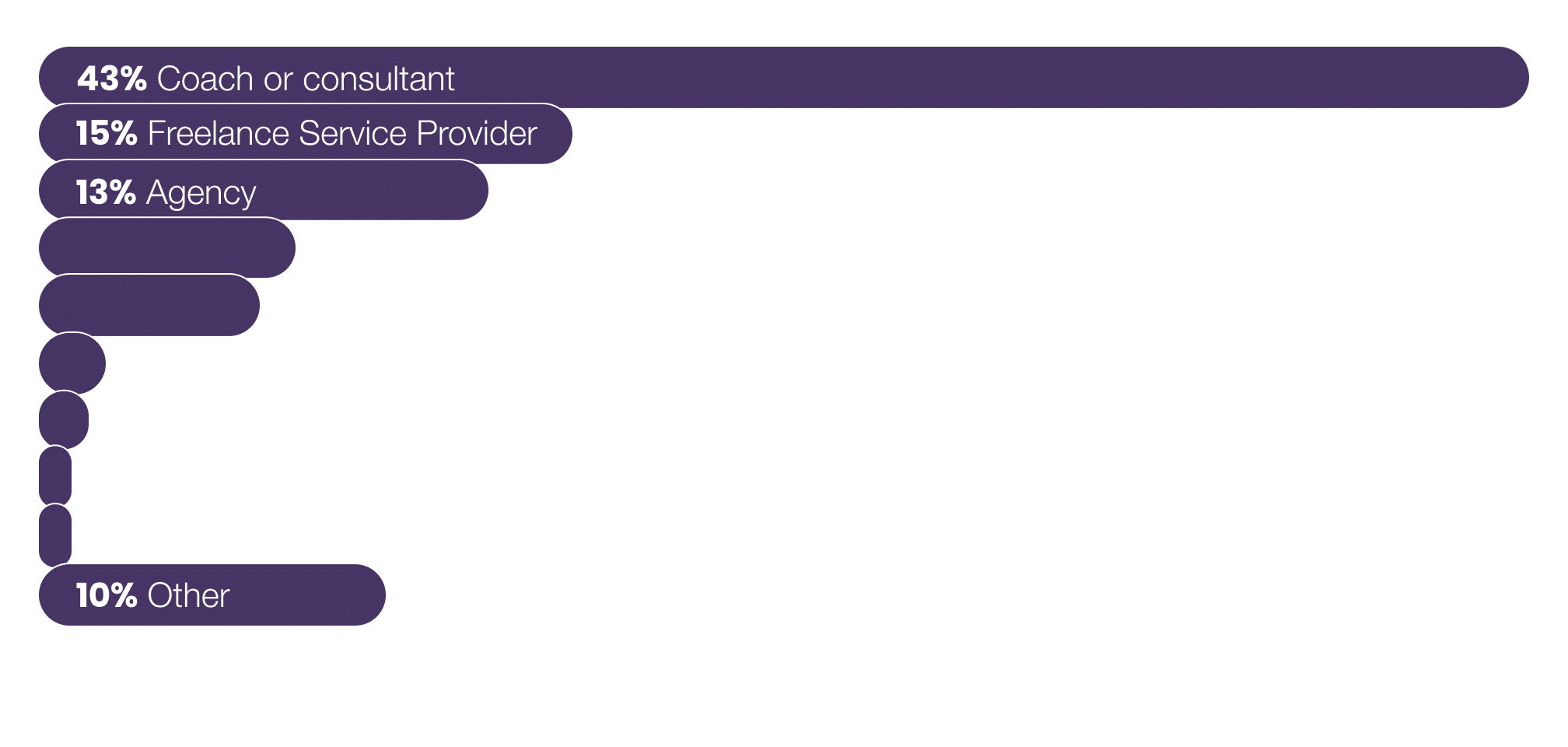

Business Model

Respondents for whom generating an income is at least part of the reason they produce their shows, these are the business models they’re pursuing.

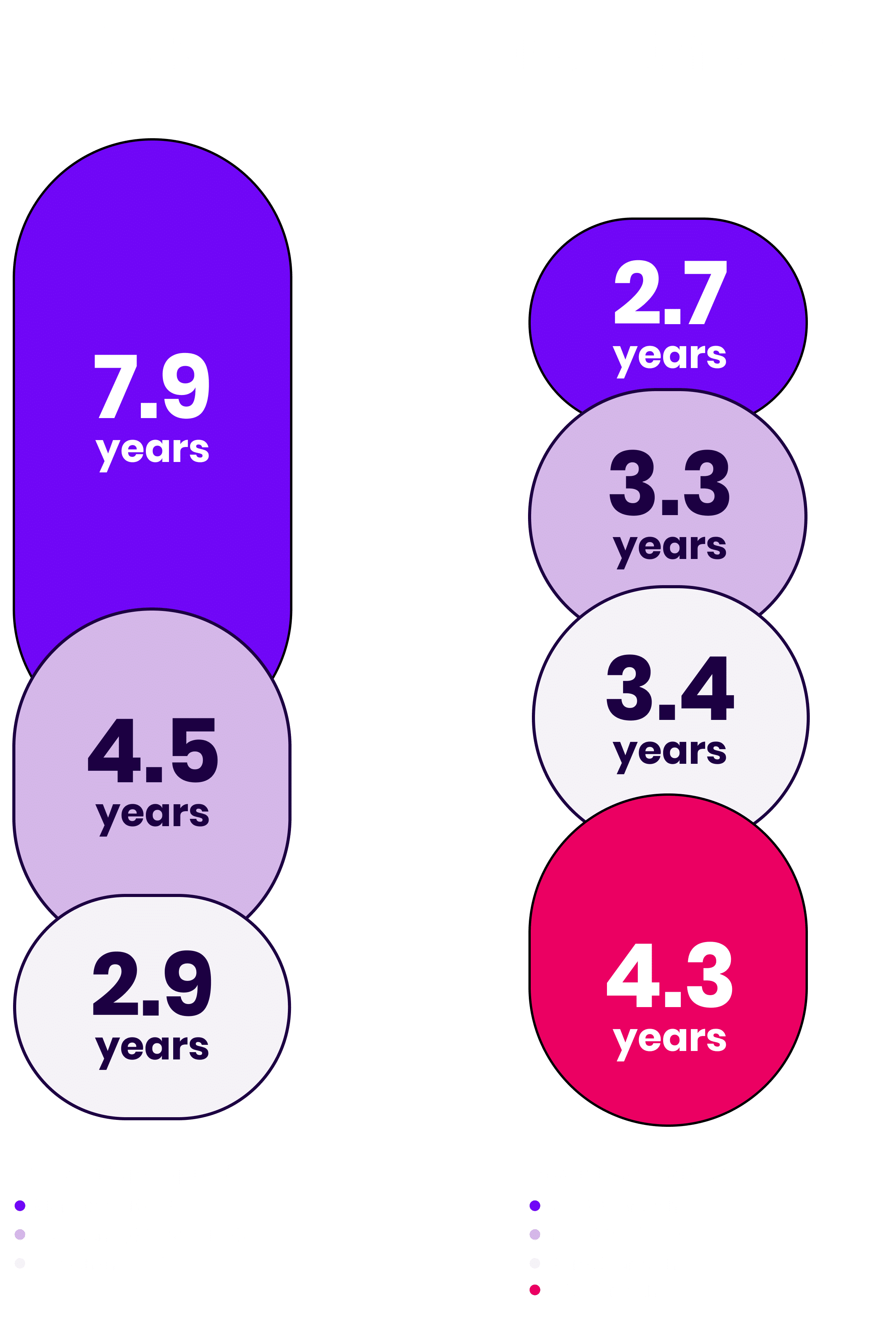

Podcasting Experience

3.5

Average years of experience

-19% from 2023

02

Benchmarks

Unlike many content creation and marketing mediums, most podcasting data isn’t publicly accessible (though the Open Podcast Prefix Project is working to change that).

This lack of transparency makes it hard to know where exactly your show stands in regard to others—and which shows are worth studying to take inspiration from for your own marketing.

Methodology

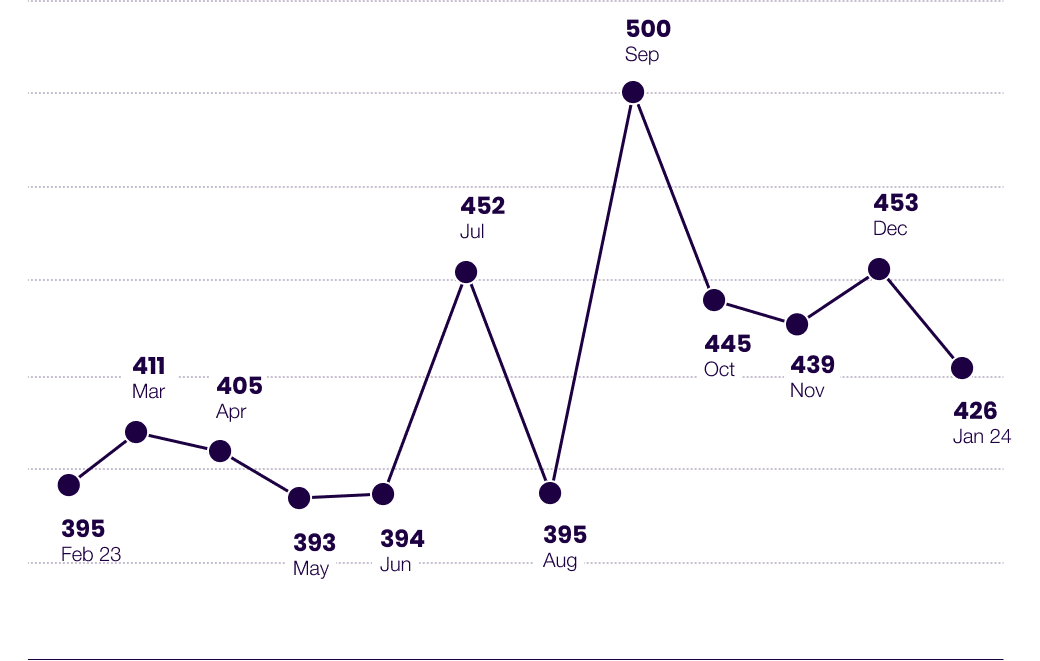

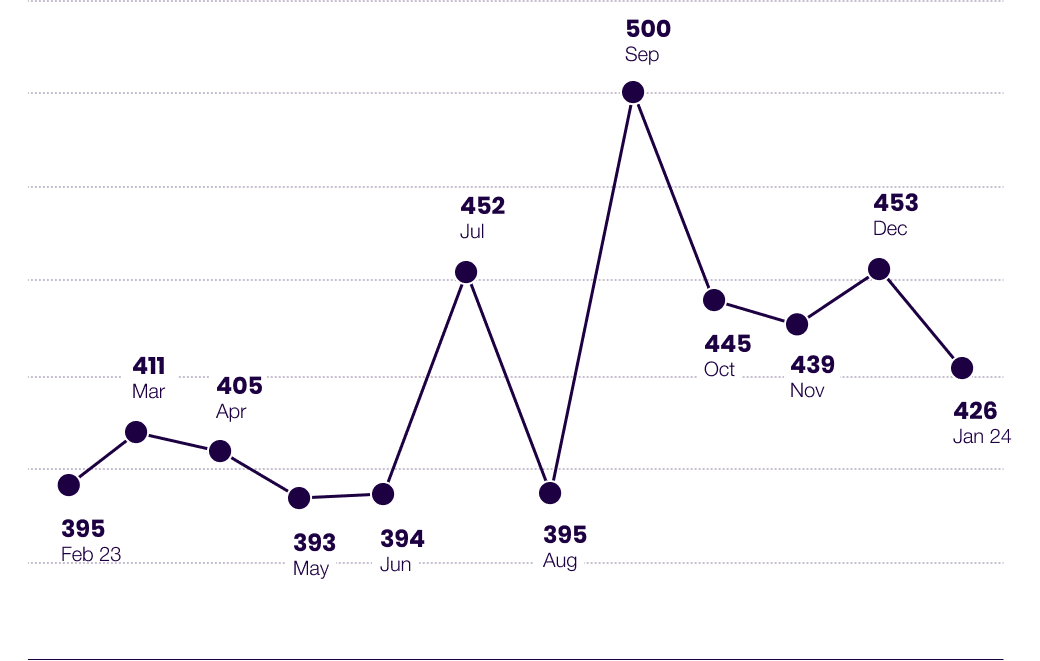

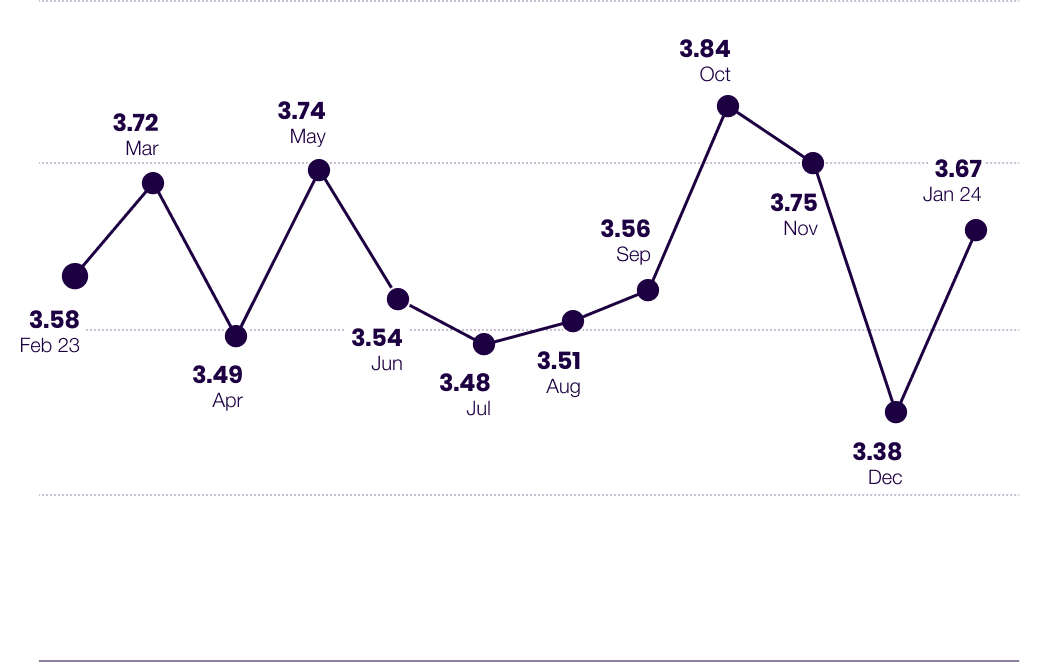

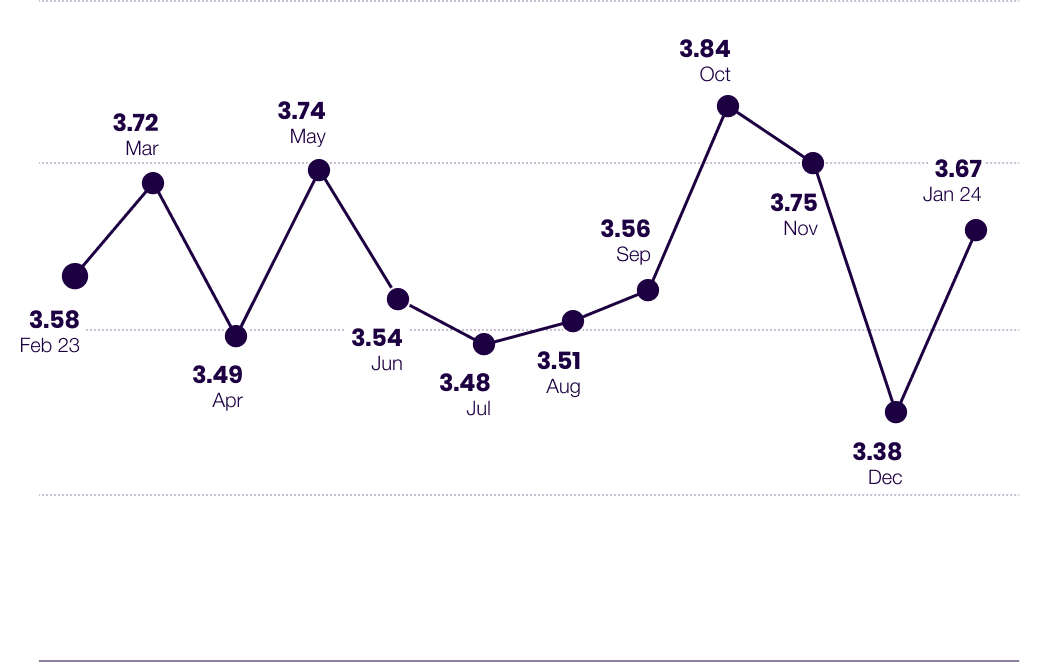

For these benchmarks, we only used data from the 234 hosts that submitted a full 12 months of download data.

Annual Trends

Downloads Per Episode By Month

The Median Show Gets

425

Downloads/Episode

-1% from 2023

1,132

Downloads/Month

-21% from 2023

The Median Show Gets

425

Downloads/Episode

-1% from 2023

1,132

Downloads/Month

-21% from 2023

Downloads Per Episode By Month

Episodes Published/Month

Episodes Published Per Month

Key Takeaway

A few things stand out to us from this section, the first of which being the obvious decrease in episode production over the summer and winter holidays.

These dips are significantly more pronounced than last year’s, suggesting that more creators are taking time to take time of from their shows or reducing their publish frequency in order to recharge.

The second insight is that audience consumption does not necessarily correspond with publish frequency.

July, September, and December were all low months in terms of the number of episodes published… yet the top 3 in terms of downloads per episode.

This suggests audiences with more time around the holidays may be using it to catch up on back catalogue episodes they’d previously missed.

In terms of big picture trends, it’s interesting to note that in our 2023 report, every month saw an average of more than 4 episodes released, while this year, no month reached the 4-episode threshold.

Lastly, we have to note the impact of Apple’s iOS 17 rollout, which rolled out in earnest in late November, and may be the culprit in January’s drop off in reported downloads.

For more on the impact of iOS 17, check out Podnews’ timeline of events.

Podcast Growth Rate Benchmarks

How quickly does the typical show grow?

As a podcaster, a benchmark growth rate allows you to calculate how many new listeners you can expect to bring in each month, which allows you to assess the effectiveness of your marketing, make better-informed growth & revenue projections, and a whole lot more.

Month-Over-Month Podcast Growth Rate

Annual Growth Rate

Key Takeaway

We were more than a little depressed when we uncovered last year’s median growth rates of 1.62% month-over-month and 21% per year.

Compared to this year, however, the 2023 median rates look absolutely rosy, with the typical show among our respondents barely achieving any growth at all over the course of the year.

On the other hand, many of the shows that did grow grew phenomenally well, as shown by the fact that the overall average annual growth was nearly 100%, a number which is inflated significantly by a number of ultra-high-growth outliers.

In 2023, just one show eclipsed a growth rate of 400%—the top growth show with an annual growth rate of 565%.

In this year’s survey, however, nine shows eclipsed the 400% mark, with three eclipsing 1,000% annual growth, and our top show clocking in at 6,397% growth, going from 274 downloads per episode at the start of the year to 17,829 downloads per episode at the end.

The takeaway? Growth is less of a given than ever, but it’s certainly possible, including in explosive quantities for the right shows with the right strategies.

Annual Growth Rate Distribution

As hinted at by the difference between the average and median growth rates, this past year has been defined by a podcast landscape where most shows struggled to grow at all… while some posted incredible growth numbers.

While it’s always going to be easier to post impressive growth rates as a small show (it’s easier to double a show from 100 to 200 dl/ep for example than go from 100k to 200k), this year’s report featured several seriously big shows that doubled in size over the past year.

Here’s the overall breakdown of growth rates by starting show size.

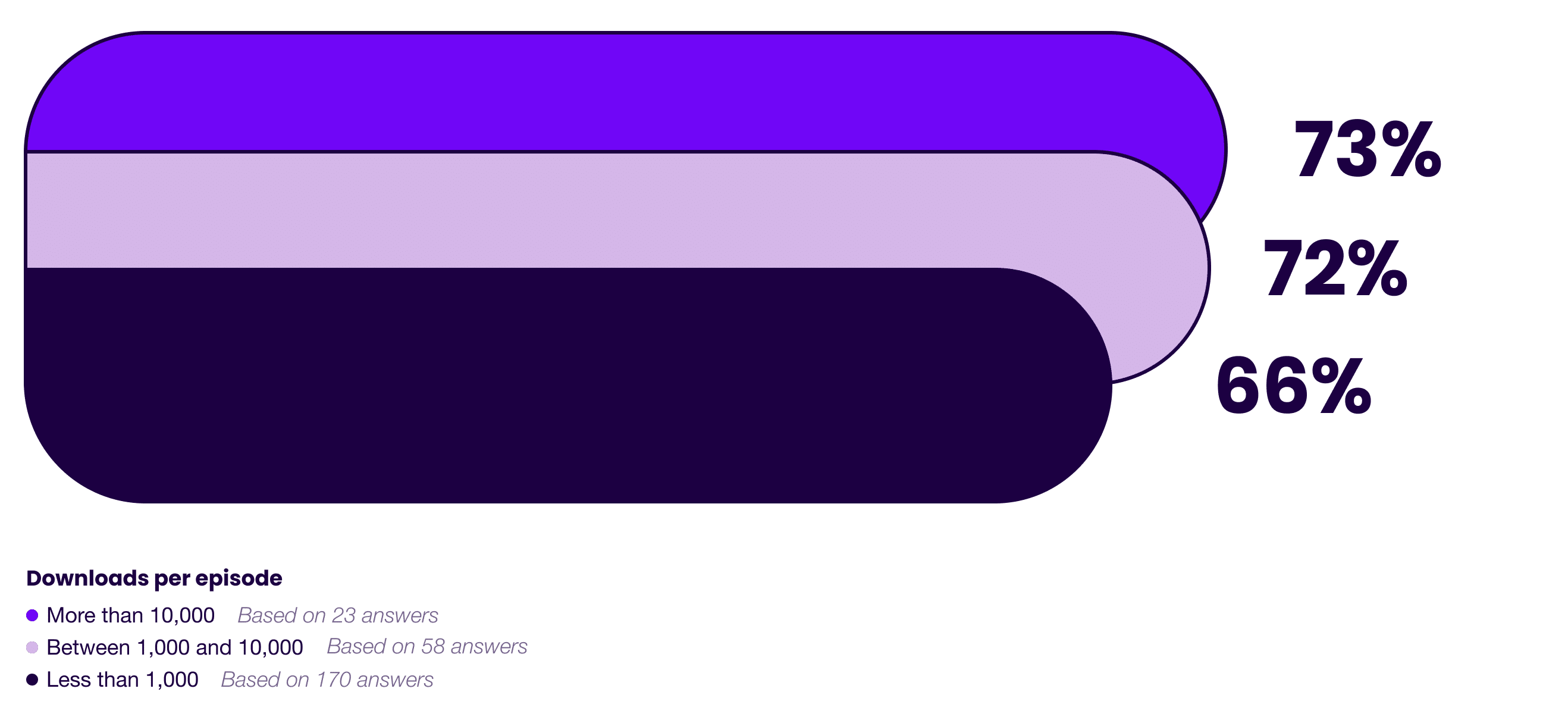

How Likely Is Growth?

Many creators assume that there’s nowhere to go but up after launching a show.

And while that be true when you’re starting from zero, our findings clearly illustrate that for established shows, growth is not a given.

In fact, this year, the prospect of growth for the typical show was little more than a coin flip.

Key Takeaways

In 2023, growth was the most likely outcome for shows of all sizes.

In fact, roughly 70% of shows with fewer than 10,000 downloads per episode grew by some amount over the course of the year.

This year, however, the tide has rushed out, with the most likely outcome for all shows with more than 1,000 downloads per episode being to shrink in size.

Only the smallest group of shows—those with fewer than 1,000 downloads per episode was growth of any amount still the likeliest outcome, yet even that was barely better than a coin flip.

Podcast Episode Consumption Benchmarks

67.7%

Average episode consumption rate

+3% from 2023

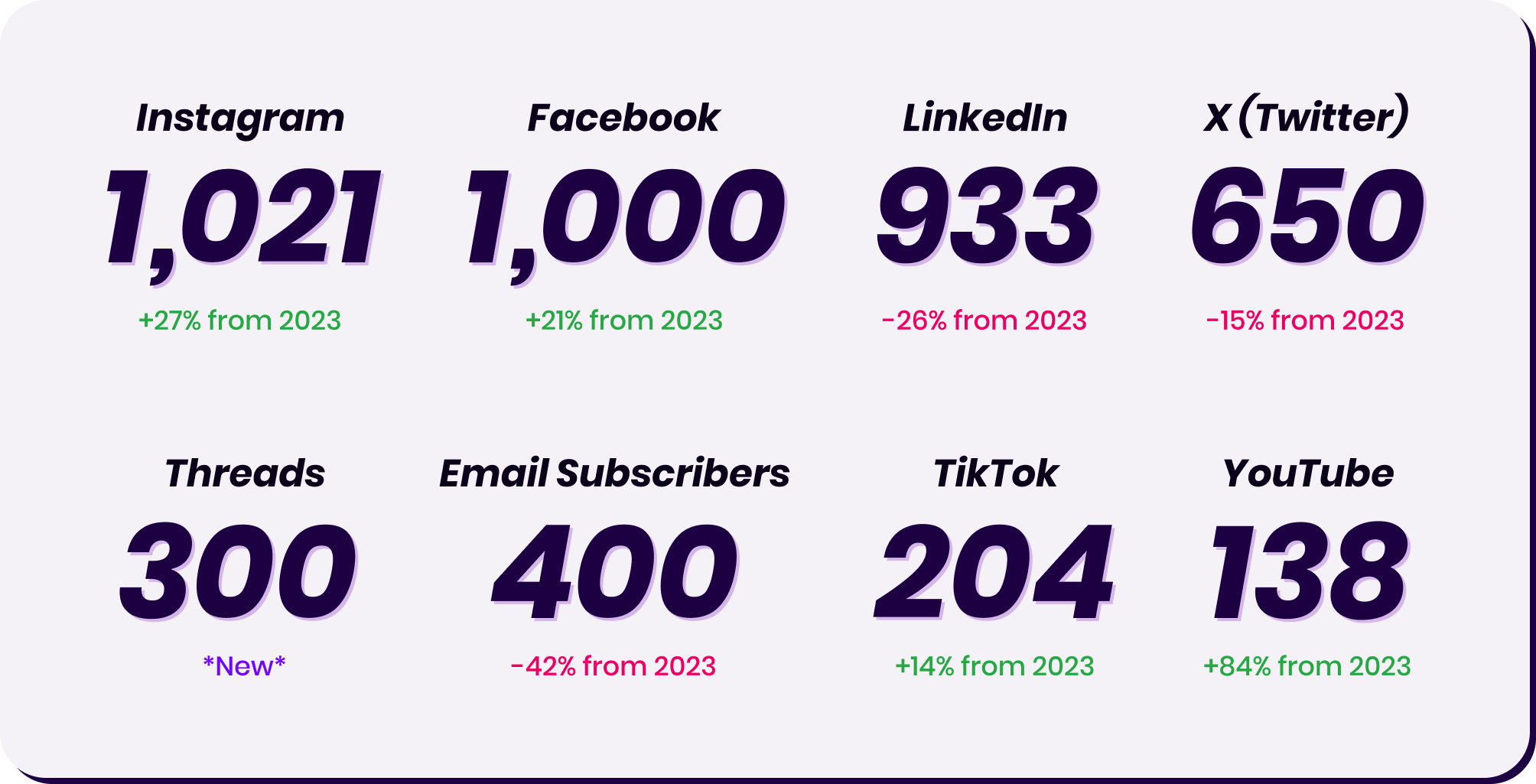

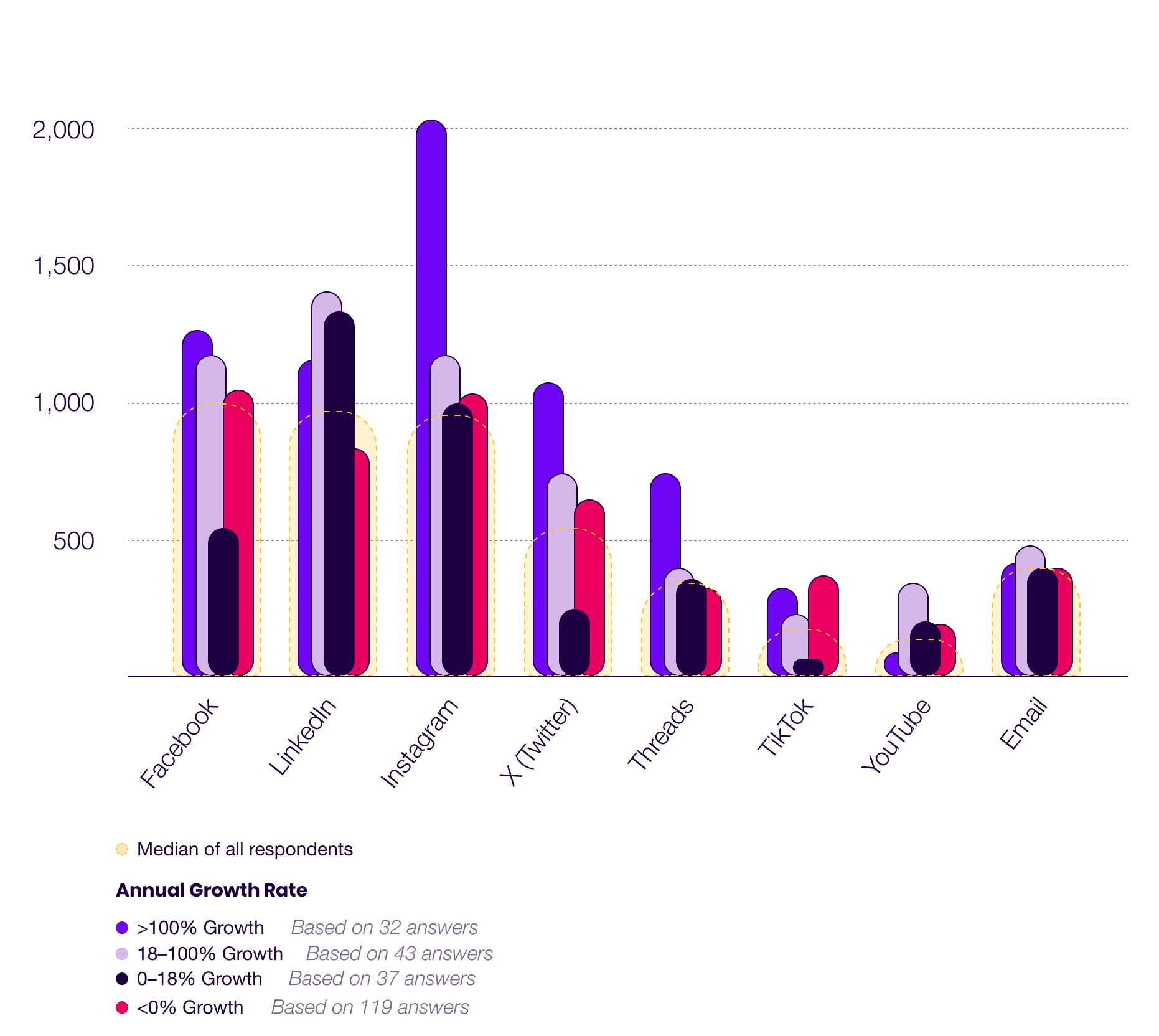

Cross-Platform Audience Sizes

Given the lack of a universal in-built discovery & monetization structure for podcasting, it’s not surprising that podcasters tend to be multi-platform creators.

In fact, of our 515 respondents, just three indicated that they were not active on any other marketing platforms.

When it comes to non-podcast content platforms, here’s how our respondents are faring, based on the median follower/subscriber count for each platform in our data set.

1,021

+27% from 2023

Threads

300

*New*

1,000

+21% from 2023

Email Subs

400

-42% from 2023

933

-26% from 2023

TikTok

204

+14% from 2023

X (Twitter)

650

-15% from 2023

YouTube

138

+84% from 2023

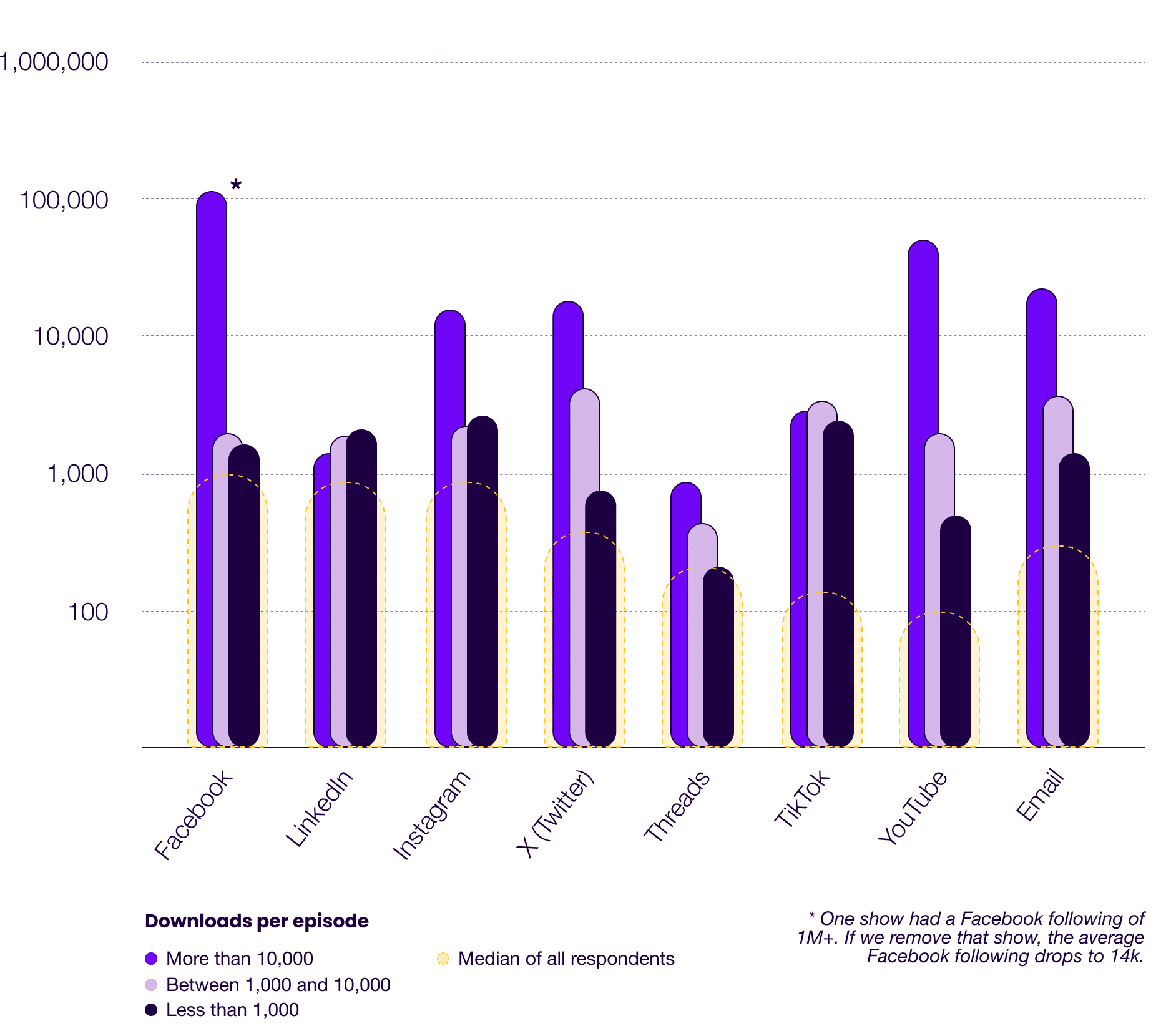

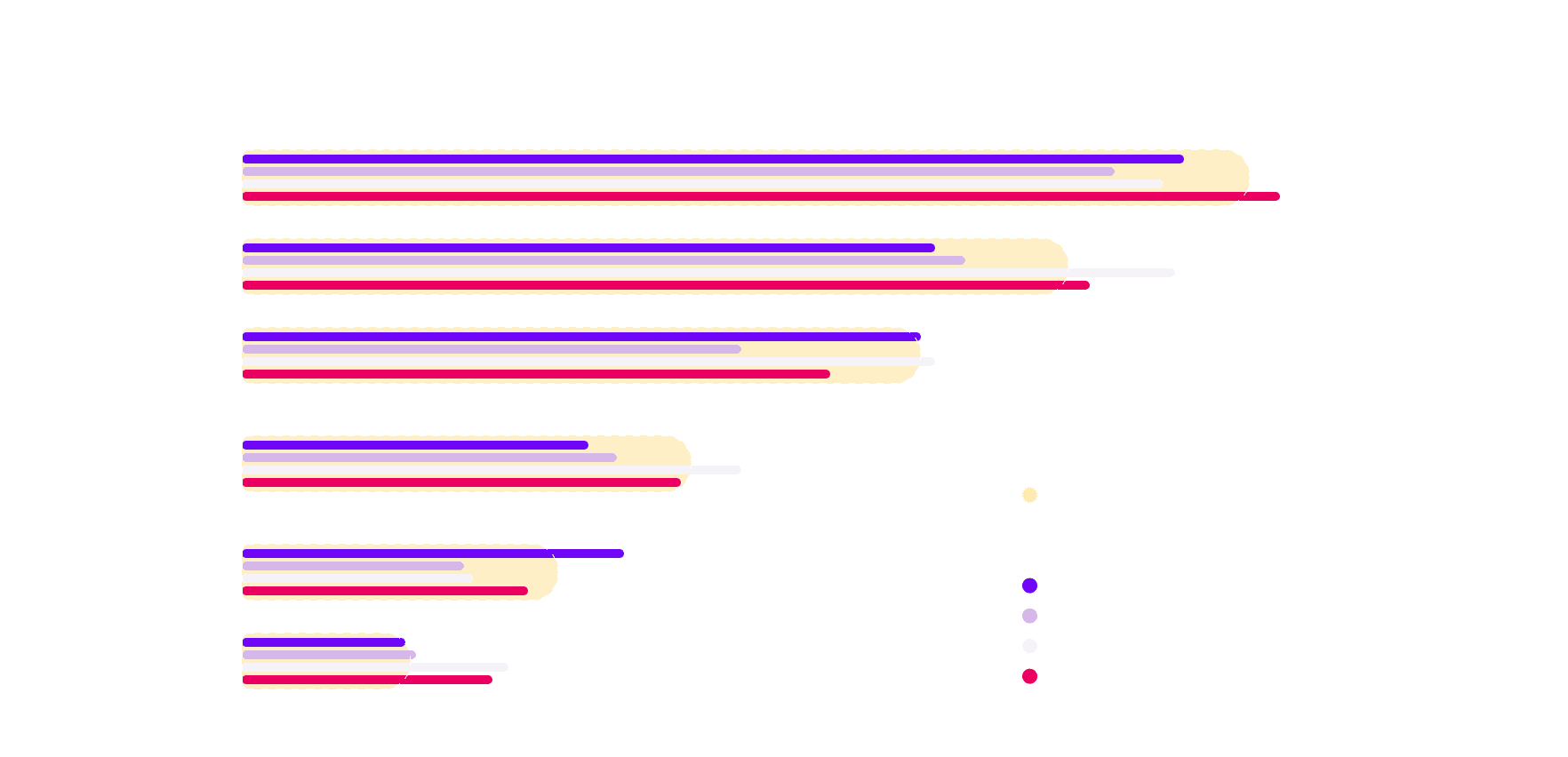

Cross-Platform Audience By Show Size

Key Takeaway

While it’s impossible to prove, it also feels plausible to posit that these long-term, highly successful creators have developed a better sense of how to create engaging content on any platform.

Note: The overall median numbers (seen in yellow on the chart) include shows that did not submit a full 12-months of download data whereas the size-segmented groups are based on the subset that did. This is why the overall median numbers are typically lower than the segmented groups who are necessarily more established.

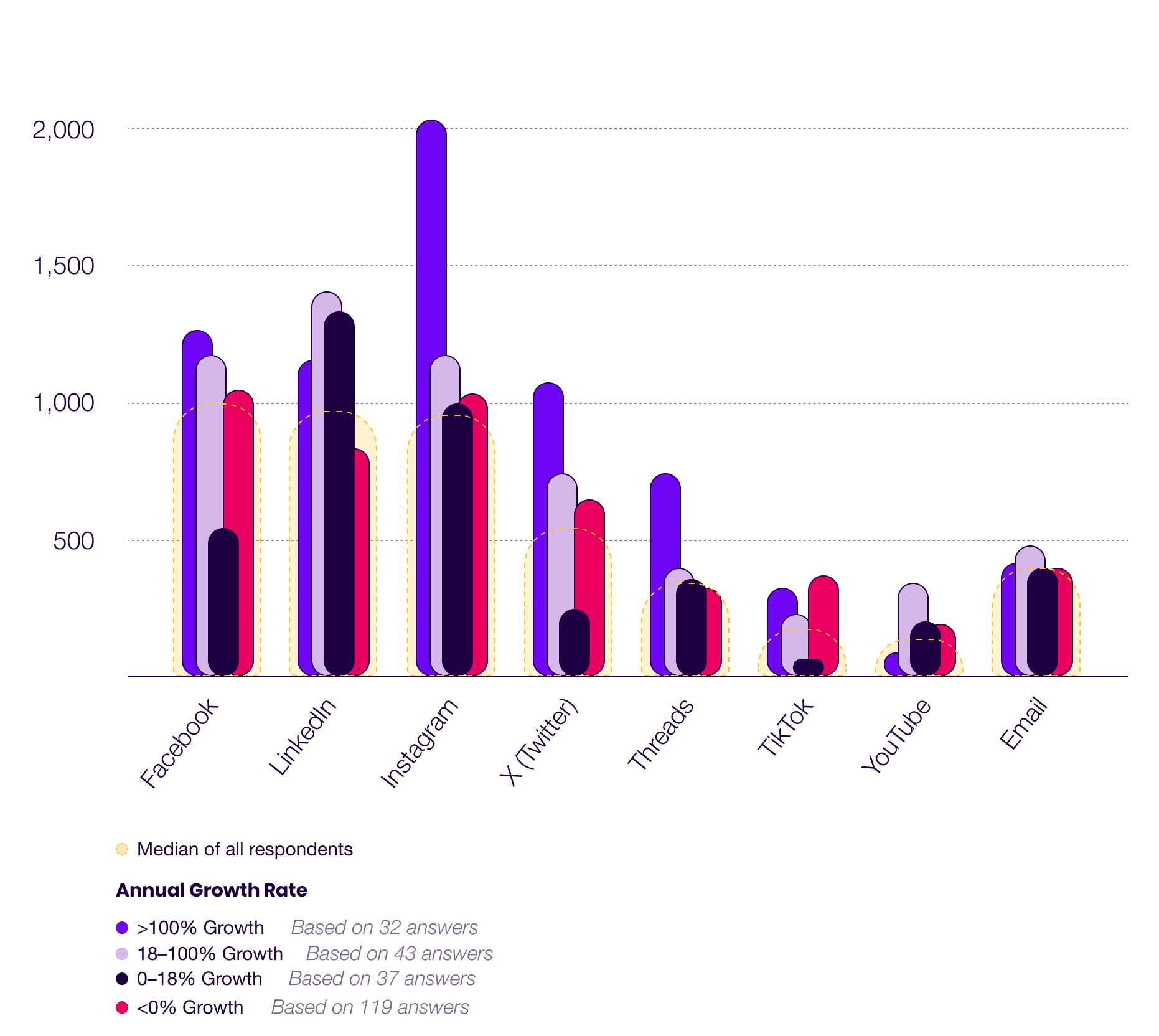

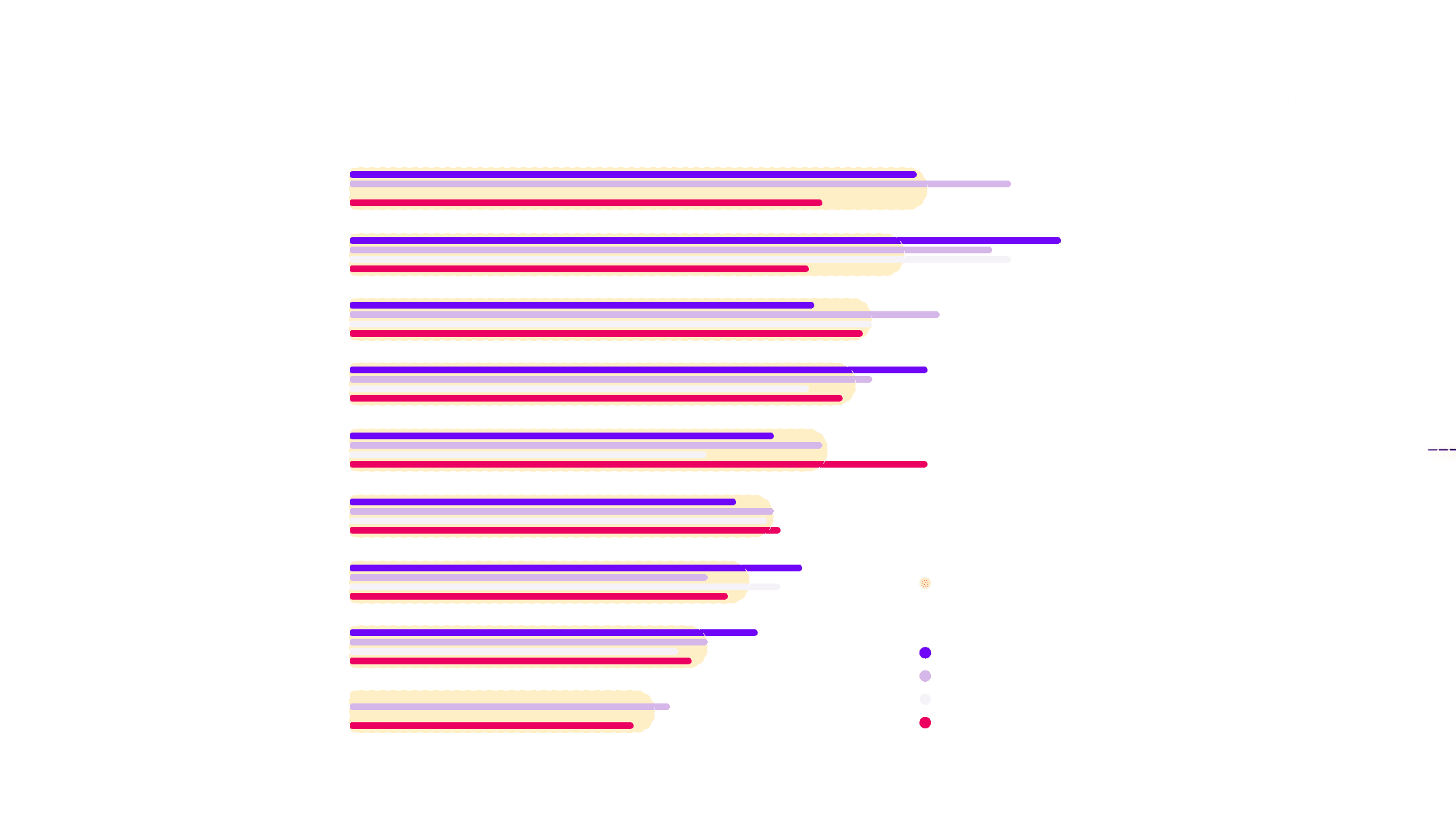

Cross-Platform Audience By Growth Rate

Key Takeaway

The highest growth podcasts were the outliers on several platforms, including X (Twitter) and Threads.

Nowhere was the disparity in audience size more obvious, however, than Instagram where shows that doubled in size had more than double the median number of followers compared to the typical respondent.

Also worth noting is the fact that while big shows tended to have large YouTube followings, high-growth shows did not.

Key Takeaway

The highest growth podcasts were the outliers on several platforms, including X (Twitter) and Threads.

Nowhere was the disparity in audience size more obvious, however, than Instagram where shows that doubled in size had more than double the median number of followers compared to the typical respondent.

Also worth noting is the fact that while big shows tended to have large YouTube followings, high-growth shows did not.

Demystify Podcast Marketing

This report is just the start. Sign up to get a steady stream of daily, bite-sized (often unorthodox) podcast growth & marketing micro-lessons through our Scrappy Podcasting Newsletter.

03

Show Attributes Correlation with Growth Rate

There’s a lot to be said about the impact that specific marketing strategies and tactics have on growth. And we’ll get there.

But before we get to the tactical stuff, we wanted to look into various structural elements that are inherent to a show and their correlation with growth rates.

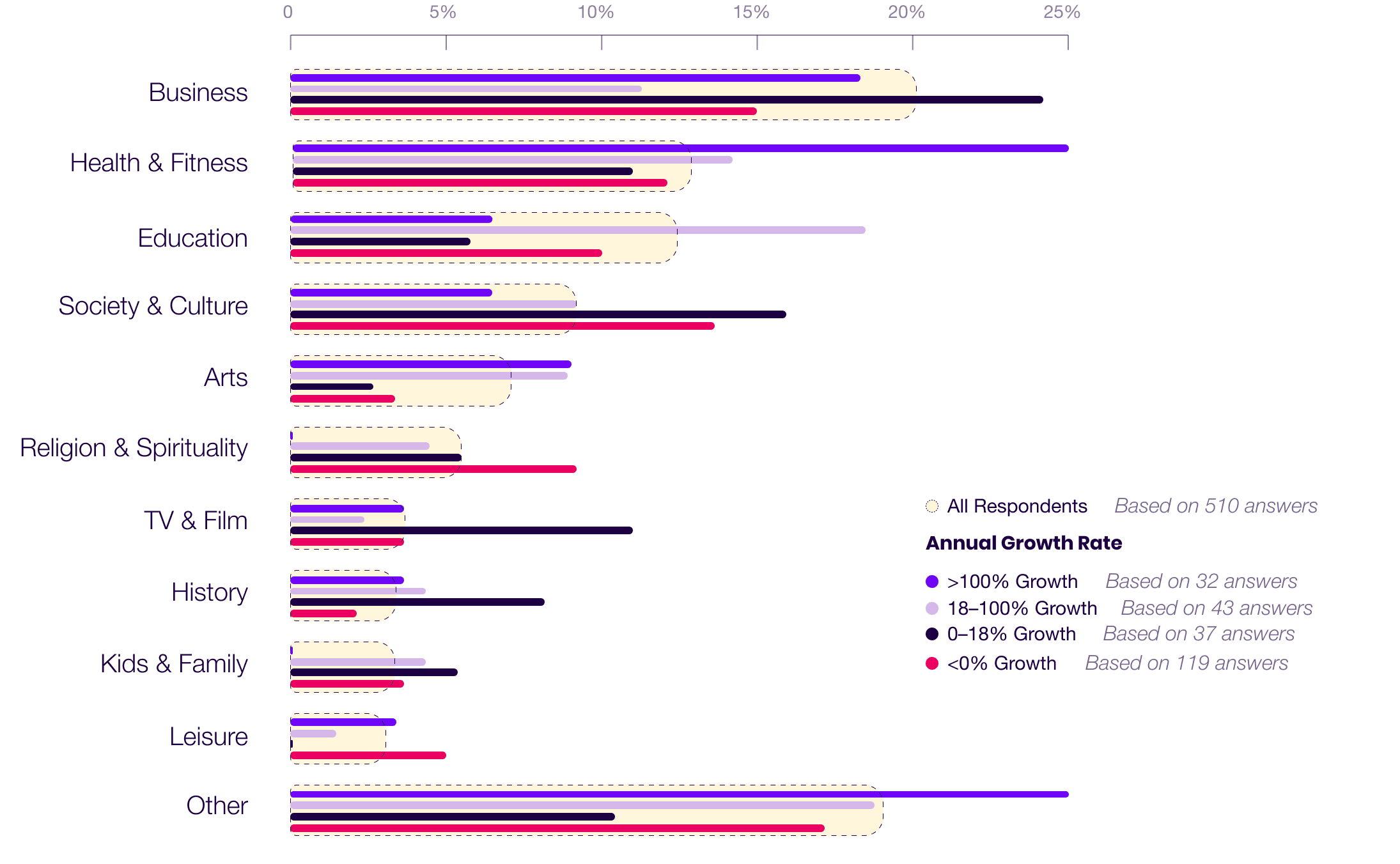

Show Topic By Growth Rate

High

Growth Trends

Compared to the overall average, shows that grew by more than 100% were:

⬆⬆ Significantly more likely to be in the Health & Wellness category.

⬆ Moderately more likely to be in the Arts category.

⬇⬇ Significantly less likely to be in the Education, Society & Culture, Religion & Spirituality, and Kids & Family categories.

Medium

Growth Trends

Compared to the overall average, shows that grew between 18%–100% were:

⬆⬆ Significantly more likely to be in the Education category.

⬆ Moderately more likely to be in the Health & Fitness, and Arts categories.

⬇⬇ Significantly less likely to be in the Business, Religion & Spirituality, TV & Film, and Leisure categories.

Low

Growth Trends

Compared to the overall average, shows that grew by less than 18% were:

⬆⬆ Significantly more likely to be in the Business, Society & Culture, TV & Film, and History categories.

⬇⬇ Significantly less likely to be in the Education, Arts, and Leisure categories.

Negative

Growth Trends

Compared to the overall average, shows that shrunk were:

⬆⬆ Significantly more likely to be in the Society & Culture and Religion & Spirituality categories.

⬇ Moderately less likely to be in the Education and History categories.

⬇⬇ Significantly less likely to be in the Business, and Arts categories.

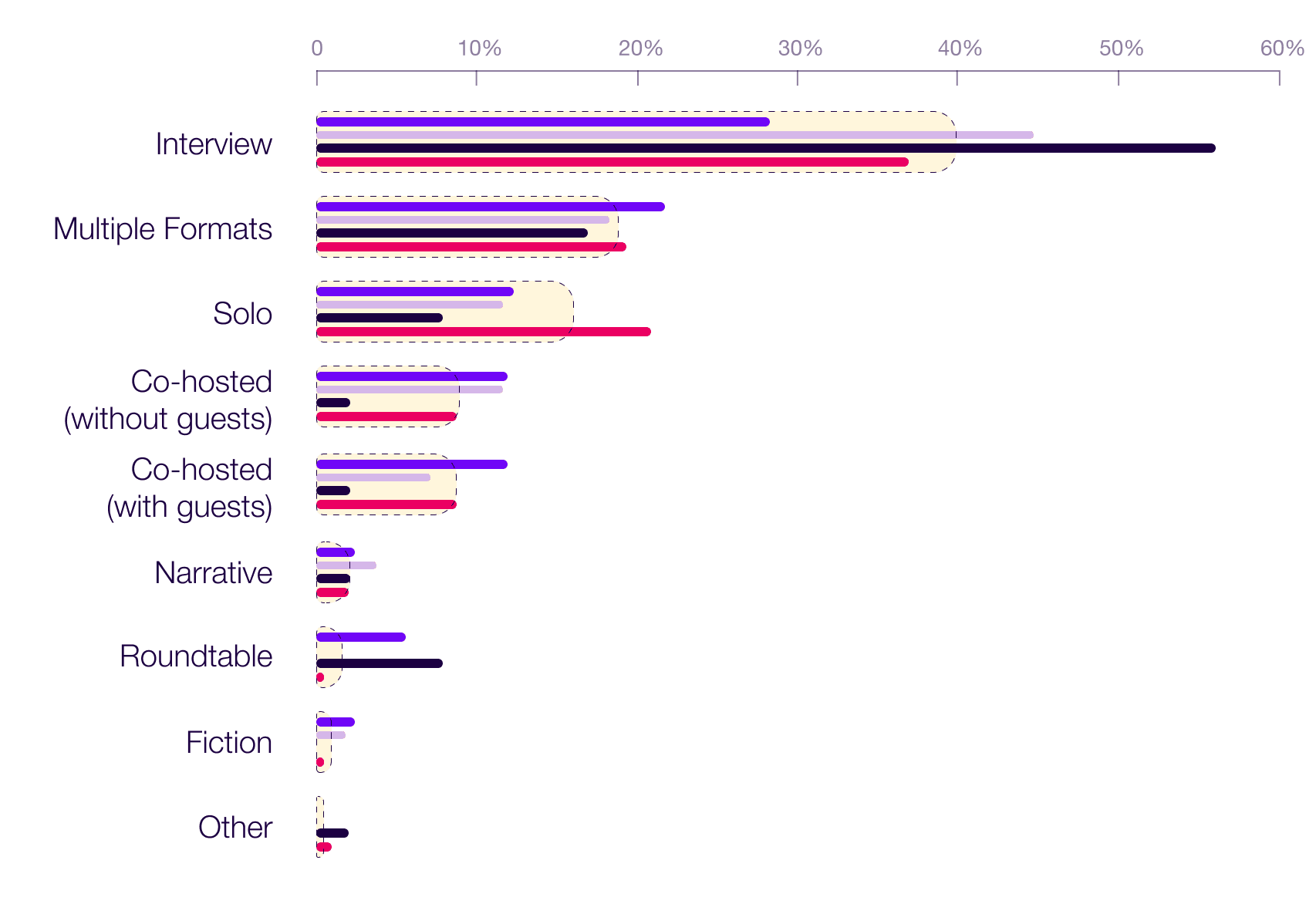

Show Format By Growth Rate

High

Growth Trends

Compared to the overall average, shows that grew by more than 100% were:

⬆⬆ Significantly more likely to use roundtable formats.

⬆ Moderately more likely to use Co-Hosted (with Guests), Co-Hosted (without Guests), and multiple formats.

⬇⬇ Moderately less likely to use strictly Solo formats.

⬇⬇ Significantly less likely to use strictly Interview formats.

Medium

Growth Trends

Compared to the overall average, shows that grew between 18%–100% were:

⬆ Moderately more likely to use strictly Interview, Co-Hosted (without Guests), and Narrative formats.

⬇ Moderately less likely to use strictly Solo, Co-Hosted (with Guests), and Roundtable formats.

Low

Growth Trends

Compared to the overall average, shows that grew by less than 18% were:

⬆⬆ Significantly more likely to use strictly interview and roundtable formats.

⬇⬇ Significantly less likely to use strictly Solo, Co-Hosted (without guests), Co-Hosted (with Guests), and Fiction formats.

Negative Growth Trends

Compared to the overall average, shows that shrunk were:

⬆⬆ Significantly more likely to use strictly Solo formats.

⬇ Moderately less likely to use Interview, Roundtable, and Fiction formats.

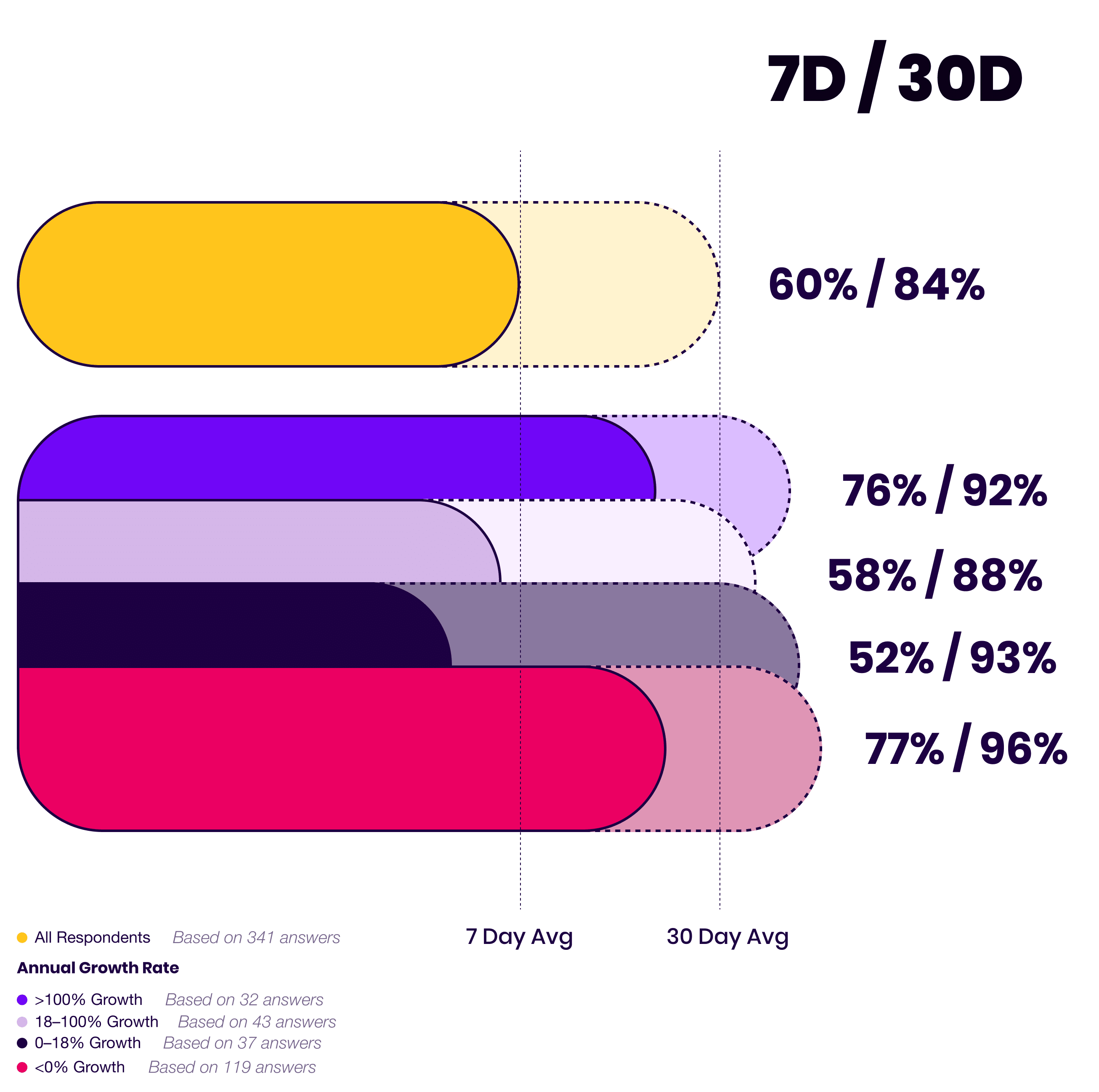

Publish Frequency By Growth Rate

This year, in addition to looking at the median number of days between publishing episodes, we looked at two additional data points to get a sense of how a show’s publishing activity influences growth.

Those additional metrics are, “Has published an episode in the last 7 days” (Yes/No) and ” Has published an episode in the last 30 days” (Yes/No).

7.3

Median days between episodes

+4% from 2023

Key Takeaway

The vast majority of respondents had published an episode in the previous 30 days. When it came to more regular publishing consistency, however, the differences started to emerge—and the correlation with growth was stark.

Shows that doubled in size were 24% more likely to have released an episode in the previous seven days than low-growth shows, which suggests that both more frequent and more consistent publishing is a contributor to growth.

The fact that the group of shows that shrunk were actually the most likely to have published in both the previous 7 and previous 30 days might seem contradictory at first. But it’s worth remembering that the shows most likely to shrink are long-running shows that have already built large, established audiences and are in the later phases of growth.

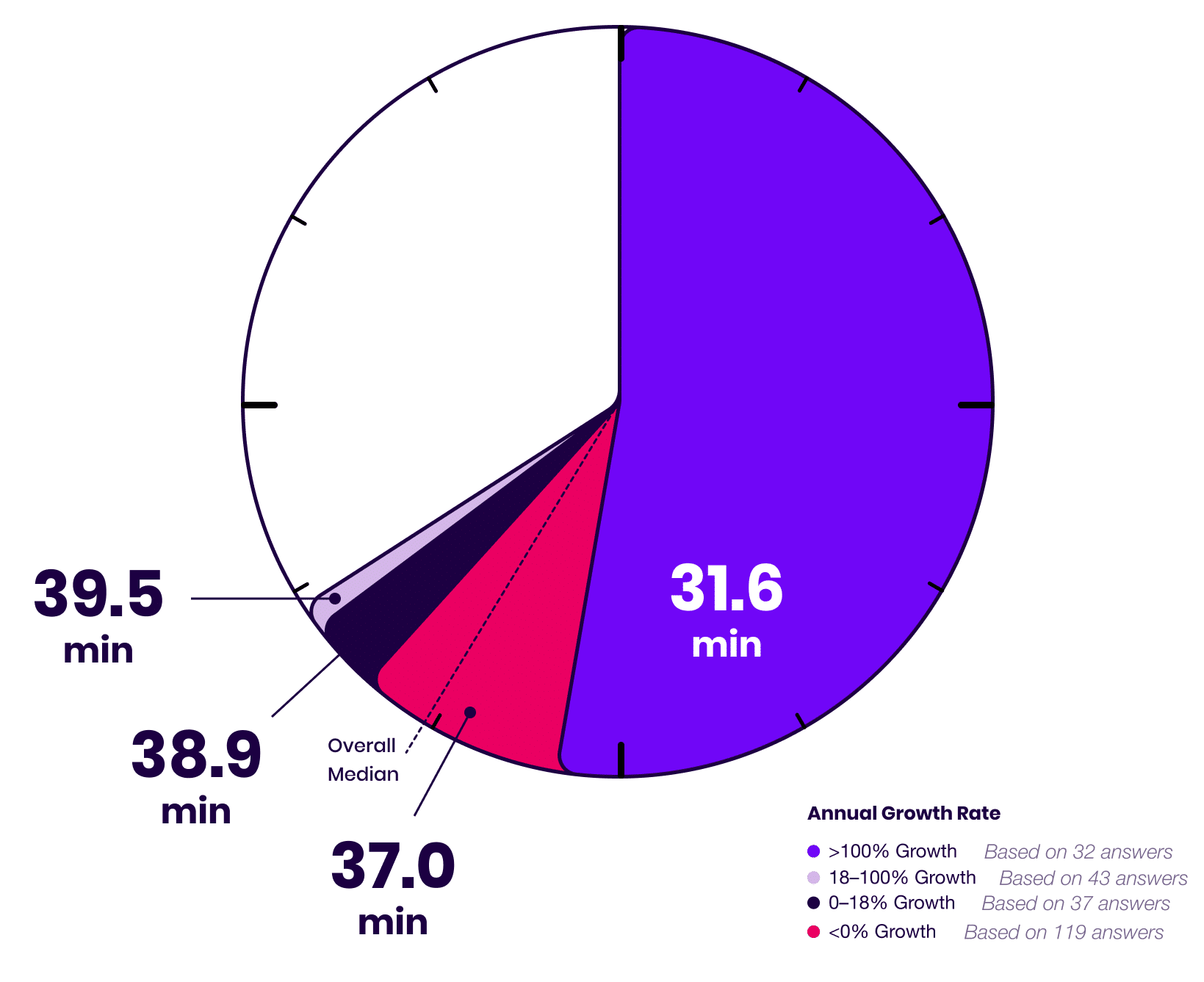

Episode Length By Growth Rate

35.1

Median episode length in minutes

5% shorter than 2023

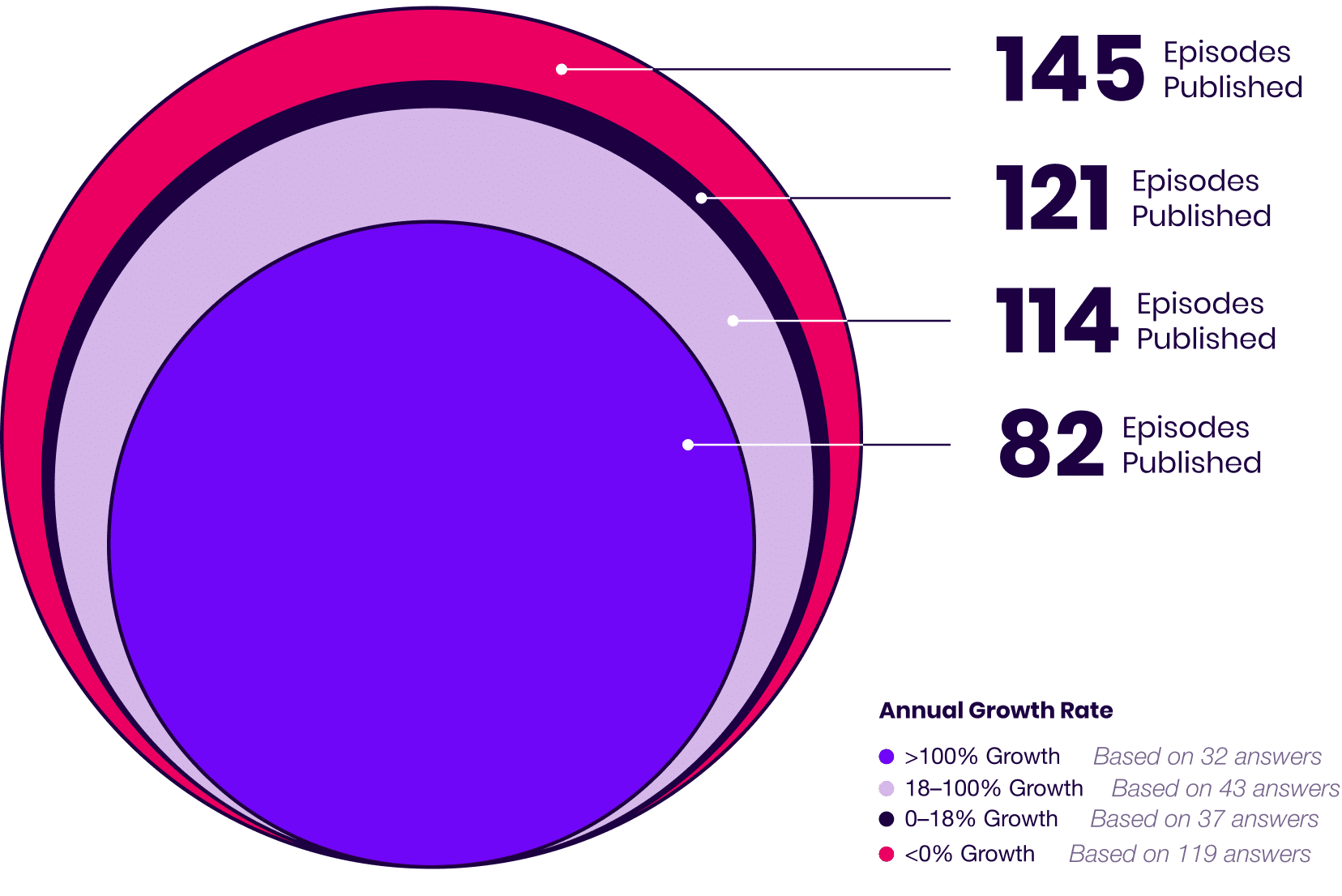

Episodes Published by Growth Rate

77

Median number of episodes published overall

+17% from 2023

77

Median number of episodes published overall

+17% from 2023

Key Takeaway

From one perspective, you might think that longer-running, more established shows would be easier to grow.

They’re likely to have more resources, more experience, and more skill than a newer show that is just starting out, after all.

From another perspective, you might think that newer shows would be easier to grow, at least when it comes to annual growth rate.

It’s easier to 10x a show with 10 downloads per episode over the course of a year than a show with 1,000,000.

And yet, while we did find that shows with fewer episodes were more likely to grow (including more likely to double in size), the shows that did so were surprisingly mature.

The typical show that doubled in size, for example, had published 82 episodes shortly after the time of submitting their annual download data.

Given the fact that the typical show across all growth rates published once a week, we can assume that most of the shows that doubled in size had already published between 20-30 episodes before their phase of significant growth.

Does Social Media Actually Grow Your Podcast Audience? (& If Not, What Are Your Other Options?)

How We'd Spend $500/$2,500/$10,000 to Grow Our Podcast (& the Lessons You Can Apply to Any Budget)

The 10k Timeline: How Long It Actually Takes to Reach 10k dl/ep (& How to Accelerate the Process)

04

What High-Growth Podcasts Do Differently

There’s no doubt structural elements such as topic, format, and length play an important role in growth.

But what about the day to day and week-to-week marketing and promotional activities?

Heres what we found.

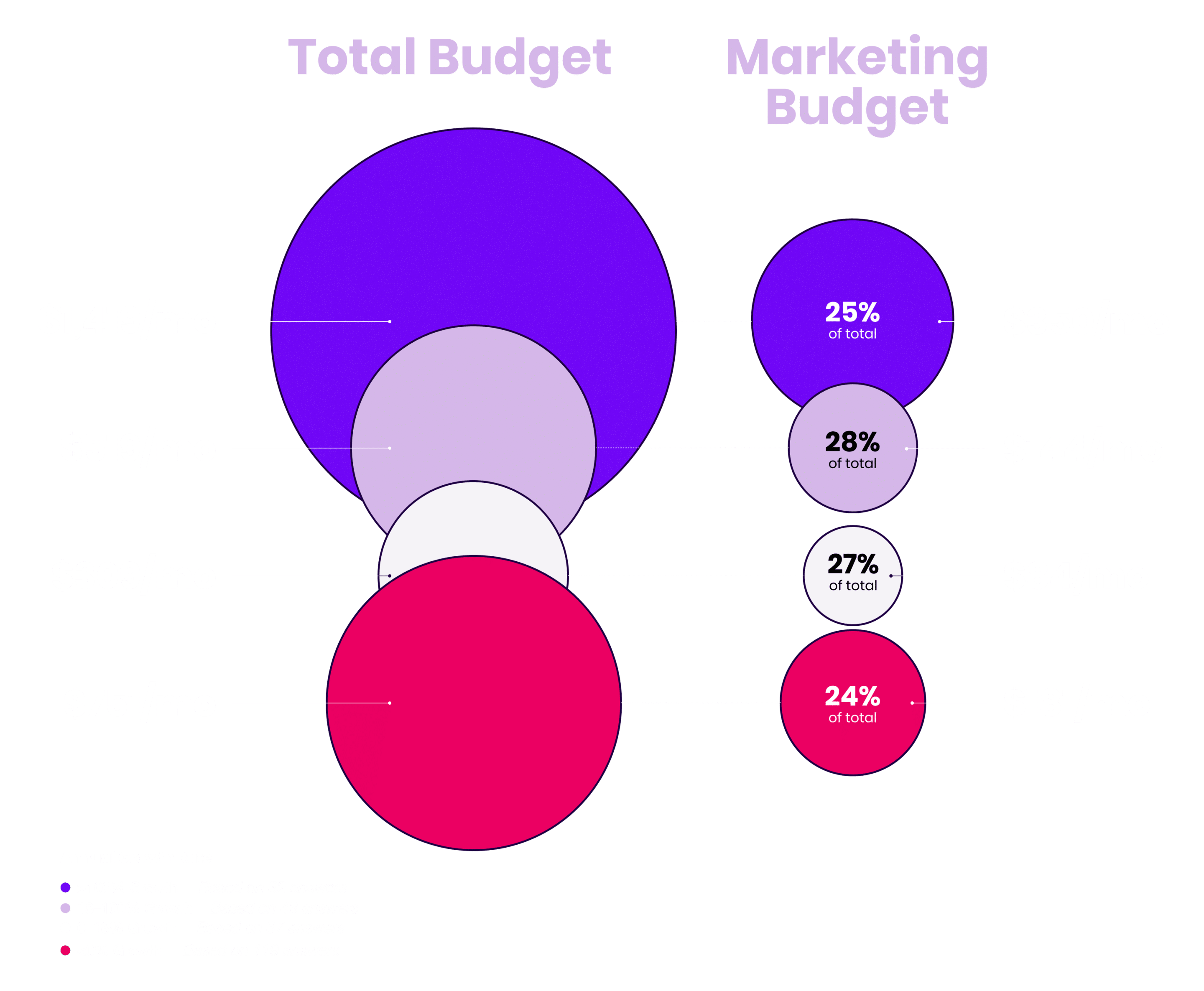

Monthly Podcasting Budget

Key Takeaway

There appears to be a clear connection between growth and budget, with the highest growth shows spending nearly 3x as much as the medium growth shows and nearly 5x as much as low growth shows on a monthly basis.

It’s interesting to note that most of that budget is not spent directly on marketing and promotion, however.

This suggests that high-growth shows are instead investing more into the show’s production, ie. making a better show.

This aligns with what every seasoned podcast marketer will tell you: If you want to grow a podcast, you need to start with a truly exceptional quality show, from show idea, to concept, to production.

Then—and only then—will promotion make any difference.

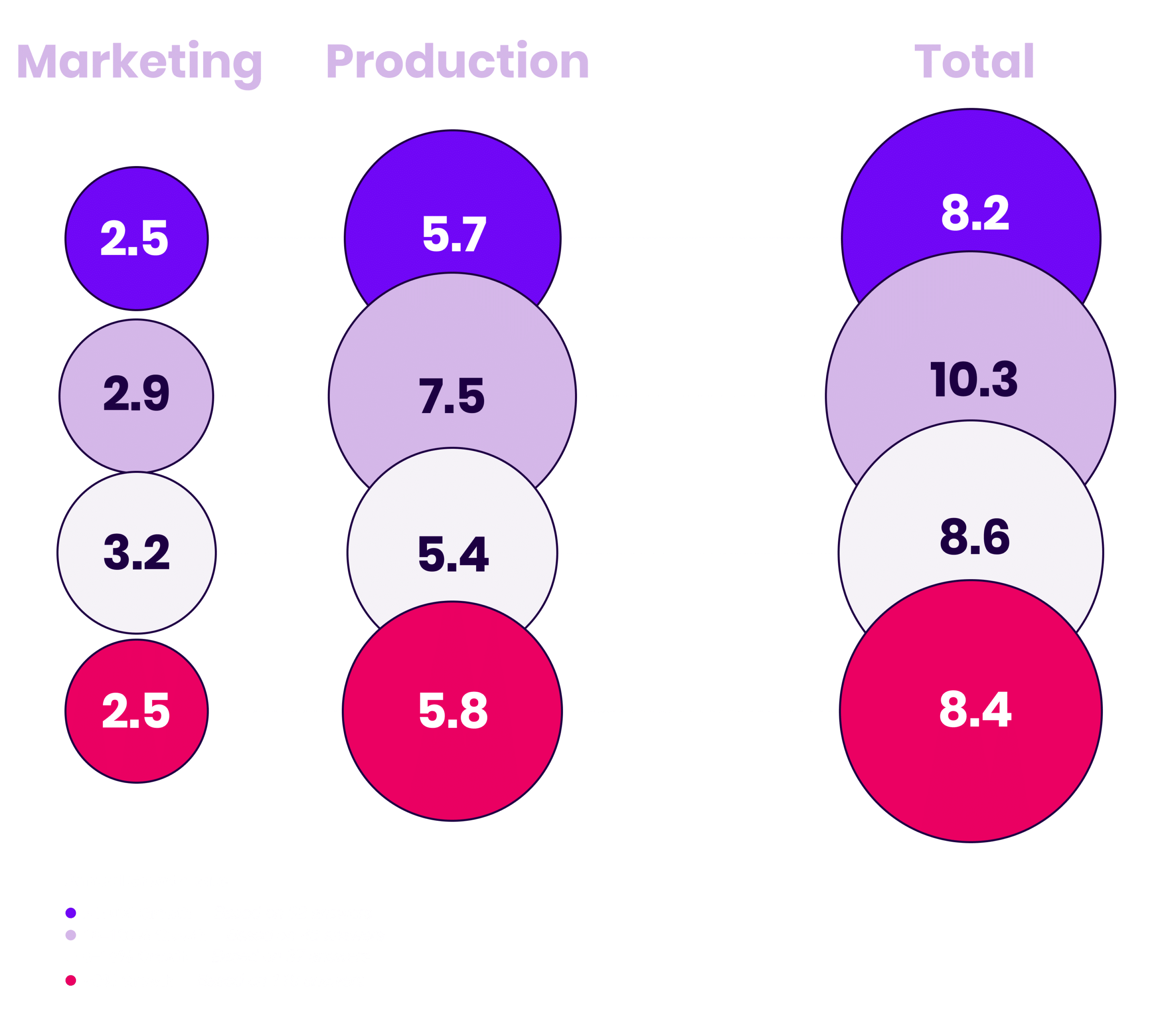

Weekly Time Investment (Hours)

Key Takeaway

While financial investment seemed to be clearly correlated with growth, the same does not appear to hold true when it comes to time investment.

In fact, among our respondents, the highest growth shows invested the fewest hours on their show on a weekly basis.

How could this be?

Here are a couple of ideas.

1. It’s likely that at least some of the additional financial investment made by high-growth shows was spent on hiring, thus reducing the creator’s weekly time investment in creating and marketing the show.

2. In our experience, the highest growth shows are built around an attractive concept with an immediately engaging hook, and (intentionally or now) tap into a strong audience appetite that already exists in the market.

The result is a show that takes less time to make and market but gets much better results than a show that doesn’t have these factors working in its favour.

This is why we stress the work of concept development so heavily when working with clients and students—it’s the biggest effort and resource amplifier available to you.

How Effective Are Various Podcast Marketing Channels

We asked respondents to rate the effectiveness of each of the marketing channels they’d employed over the past year on a scale from 0 (Not Effective) to 10 (Highly Effective).

Here’s what they told us.

Key Takeaway

The responses to this question make clear that there’s no silver bullet when it comes to growth.

Even the highest-growth podcasters were reluctant to rate any one tactic or marketing channel as “Highly Effective”.

Instead, what we see is a series of channels that work with varying degrees of effectiveness for different shows and different creators—likely with varying degrees of savviness and experience in implementing them.

What might be most notable about the ratings is that paid growth options, including both advertising and hiring podcast growth services that promise to deliver downloads, were consistently ranked as the least effective marketing channels.

Only slightly above paid growth in the rankings were Social Media and YouTube, two more channels that get a lot of attention from podcast creators… but seem not to deliver on the hype.

Regularly Used Social Channels

Stop Guessing. Start Growing.

This report is just the start. Sign up to get a steady stream of (often unorthodox) podcast growth & marketing ideas through our Scrappy Podcasting Newsletter.

05

Closing Thoughts

To close, we asked respondents a series of questions about their personal experiences and feelings around marketing as a whole.

Here’s a collection of their responses.

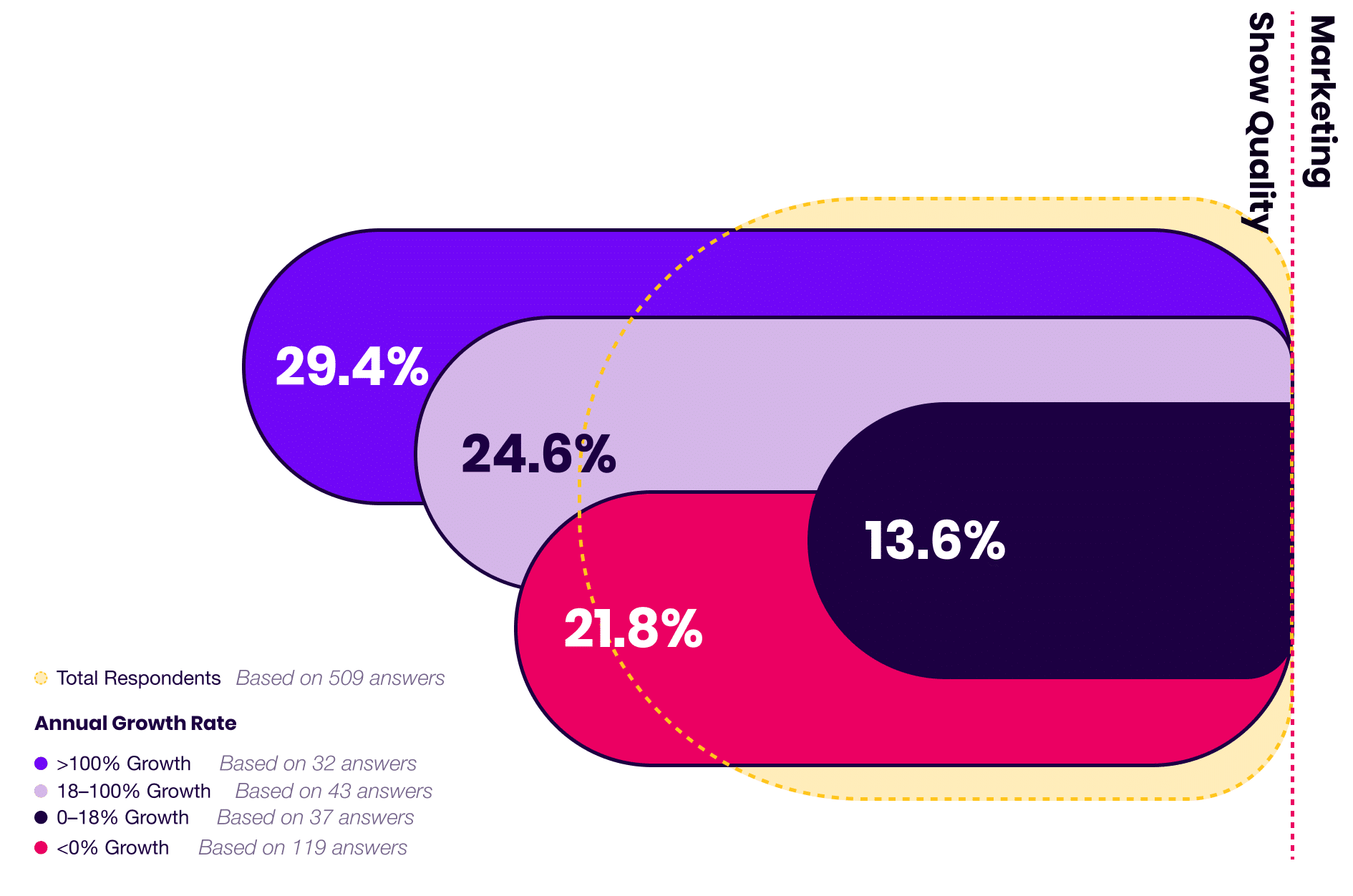

What Matters More When It Comes to Growth: Show Quality or How You Market It?

Key Takeaways

When presented with a 1–10 scale asking which was more important to growth: Show Quality (1) or Marketing (10)—with 5 being “Both are equally important”, every tier of growth indicated that show quality was ultimately more important.

It’s interesting to note, however, the degree of each group’s rating, with the high growth shows skewing furthest to the side of show quality and the low growth shows being the closest to the center.

Biggest Marketing Challenge

When asked what their biggest challenge was when it came to marketing their shows, 42.5% of respondents cited “understanding which specific strategies are effective” as the number one challenge.

How Podcasters Measure Success

This year, 74% of respondents cited podcast downloads as the primary metric they used to measure success, down 6% from 2023.

Interestingly, despite 40% of shows listing the primary purpose of their show as “growing their business”, only 8% cited an income-related metric as their primary measure of success.

Where Podcasters Learn About Marketing

Social media (70%) emerged as the resource podcasters were most likely to have used to learn about marketing, followed by podcasts (63%), newsletters (46%), and YouTube (42%).

Podcasters Are Willing To Invest

In addition to free resources, a significant number of respondents had invested in marketing education in the past year.

These paid resources included Courses (31%), Conferences & Live Events (23%), Books (21%), and Hiring a Coach or Consultant (21%).

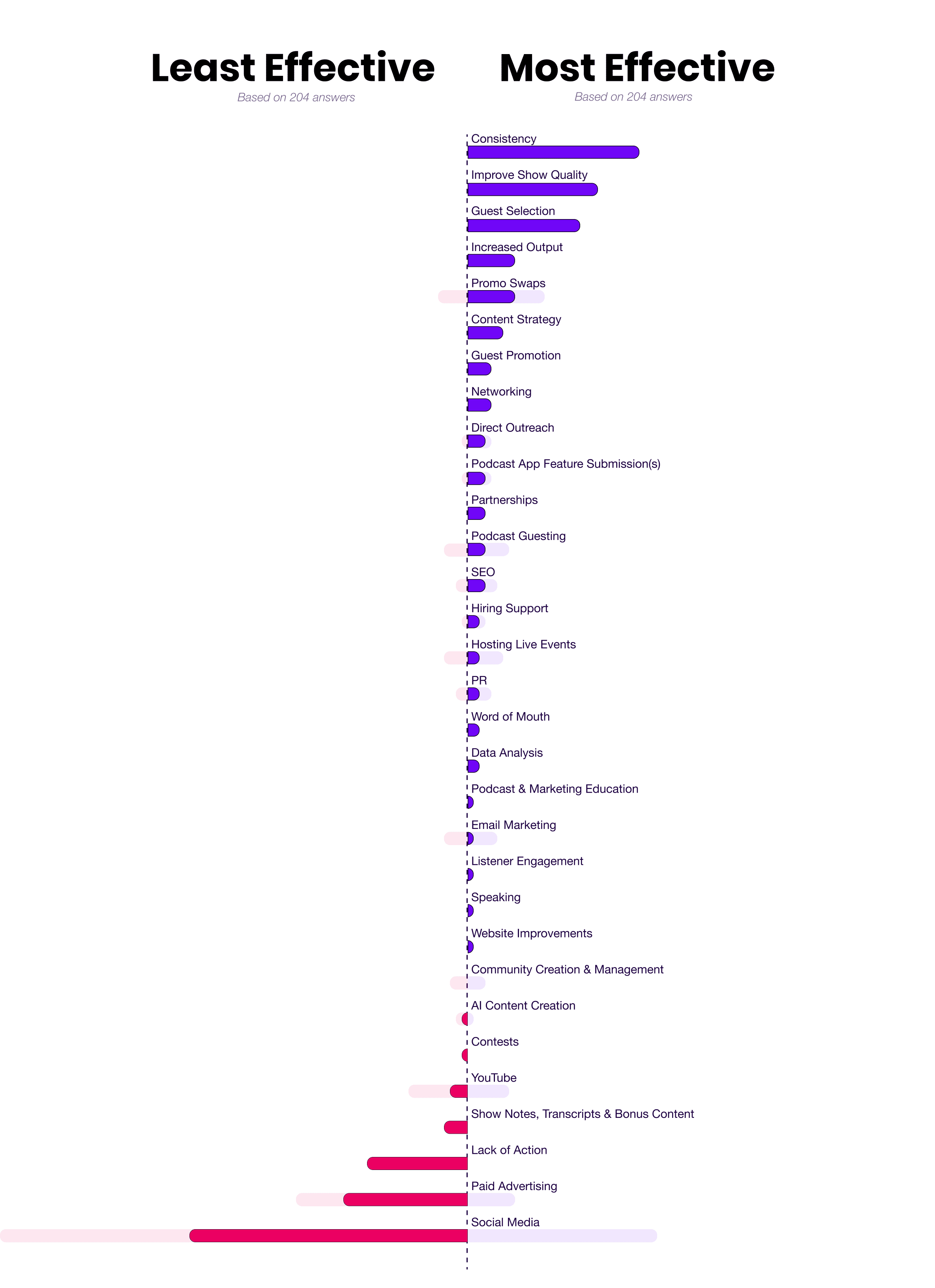

What Works (& What Doesn’t) For Podcast Growth?

Finally, we asked respondents to describe in their own words what they had done in the past year that they felt was most effective when it came to growing their show, and least effective.

Key Takeaway

In this last section, we asked respondents to share in their own words what they felt had been the most and least effective things they had done in the past year when it came to growing their shows.

This question resulted in a broad swath of answers, but some clear trends emerged.

Interestingly, the four most commonly cited “Most Effective” activities have nothing to do with what many podcasters might consider marketing.

On the flip side, the “Least Effective” activities were dominated by the two tactics that are often first to mind when podcasters think of marketing, Social Media, and Paid Advertising.

One last thing before we close this thing out.

There will always be trends and commonalities that seem to define the biggest and highest growth shows

But there will also always be outliers.

There’s no one way to grow a show.

No one format, topic, or strategy.

So don’t be afraid to buck the trend and experiment with whacky, scrappy, and unorthodox marketing strategies that no one else is doing.

They won’t always work.

But every now and then, they win big.

As with all marketing, the only way to find out is to test it.

So keep testing and share with us what you’ve learned for next year’s report.

We’ll do the same.

Deal?

Presented By

With Support From

06

Additional Podcast Marketing Resources

More Data-Driven Insights

Decode The Spotify Discovery Algorithm

The Spotify algorithm is one of the best ways to increase your exposure. But it’s also an incredible tool to help diagnose issues that are keeping you from more listeners on every platform.

Learn what the data says and how to leverage Spotify’s tools to grow faster.

Read Our In Depth Guides

The 4 Phases of Podcast Growth

If your marketing isn’t working, there’s a good chance it’s because you’re using the wrong tactics for the phase of growth you’re in. Here’s how to use the right marketing strategy at the right time

How to Become A Better Podcast Interviewer

A practical guide to improving your interviews, episodes, and guest relationships using the hidden skills, traits & practices behind truly great guest interviews.

The Definitive Guide to Podcast Hooks

The dark art & curious science of crafting a podcast that worms its way into your listeners’ minds and refuses to leave.

Subscribe To Our Free Content

Daily Podcast Marketing Micro Lessons

A daily newsletter breaking down the mechanics and the magic of making and marketing podcasts that grow, sell, and resonate.

Data-Driven Podcast Marketing Insights

Exploring the data behind the biggest and fastest growing shows to help you make better, smarter, more effective marketing decisions for your show.

Work With Us

A Step-by-Step Playbook to Your First 500 Podcast Subscribers

First500 is a self-paced video course and playbook walking you through the single hardest phase of podcast marketing: Gaining initial traction.

First500 Is Designed For:

- Established shows that have hit a plateau at fewer than 500 downloads per episode

- New shows that are looking to develop their ongoing post-launch marketing strategy

- Hosts who are new to—or intimidated by—marketing and looking for a straightforward, easy-to-follow playbook to get started

- Business owners, creators, and podcast managers looking for the 80/20 solution to gaining traction without spending hours consuming content.

Personalized, On-Demand Podcast Strategy For Businesses & Pro Creators

The PMA Membership gives you on-demand access to everything you need to grow your show, including personalized strategy & feedback, 100+ hours of podcast marketing training, dozens of step-by-step marketing playbooks, weekly coaching calls, a community of growth-oriented podcasters, and more.

The PMA Membership Is Designed For:

- Experienced business owners, professional creators, marketers, and podcast professionals looking for ongoing personalized marketing support

- Established shows that have been podcasting for at least a year and are looking to accelerate growth

- Brands & business owners looking to increase client acquisition and podcast-driven revenue

- Hosts looking to build (or grow) a robust cross-channel marketing strategy around podcasting, email, video, social, and more

Or, if you’re feeling especially saucy, you can apply to work with us directly via a personalized podcast audit, custom growth plan, and ongoing 1:1 marketing support.

Special thanks to these creators & shows for generously contributing their monthly download data.